Debt-lightening measures to continue, says CRISIL

BS Reporters Pune/Mumbai In recent months, a number of companies have sold assets to lower their debt liability. Studies suggest expected policy reforms and a buoyant capital market should lead to more such transactions, in which Indian companies are expected to raise around Rs 60,000 crore in 2014-15.

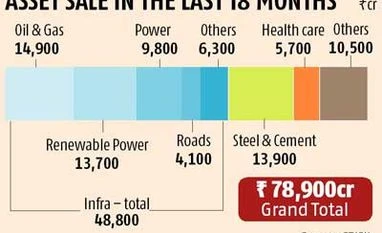

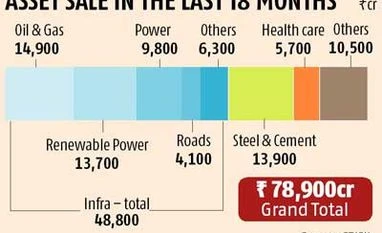

A report from rating agency CRISIL says in the past 18 months, 21 companies announced 36 deals to divest assets and sell equity to strategic partners, to raise a total of Rs 80,000 crore, nearly a fifth of their debt.

"The increasing trend to divest assets and raise equity is a part of corporates' efforts to surmount the tough phase of the economic cycle. They are now refocusing on core businesses and striving to improve balance sheets," said Pawan Agrawal, senior director, CRISIL Ratings.

In the early part of this decade, expansions and diversifications were funded primarily through debt. Over the past three years, the total debt of the 21 companies referred to earlier had increased by nearly 50 per cent to Rs 440,000 crore as on March 31, 2014, said CRISIL.

However, a slowing economy and rising interest rates meant operating profit stagnated at two per cent during the period. Consequently, asset sales became necessary to cushion the pressure on balance sheets. Companies have also reworked long-term strategies by exiting non-core businesses and divesting overseas assets.

"This should provide greater confidence to their lenders. As the economy picks up, these companies will be in a better position to benefit from emerging opportunities, as compared to the ones yet to begin this journey," Agrawal added.

The CRISIL analysis shows 60 per cent of the total divestment of assets was by companies operating in the infrastructure sector -- power, roads and oil & gas. Further, 60 per cent of the transaction value also related to non-core sectors as well as assets abroad, acquired during the economic upturn in a bid to diversify geographically.

The encouraging part, says the report, is with risk appetite improving, global investors have been seeking good quality, cash-generating Indian assets -- and were involved in a quarter of the transactions by value.

"However the extent of improvement in corporate credit profiles will be limited because asset sales also reduce operating cash flows," said Manish Gupta, director, CRISIL Ratings.

A little more than 90 per cent of completed transactions involved cash-generating assets. Even after asset & equity stake sales, the debt to Ebitda (operating earnings) multiple of these companies is expected to improve only marginally, from nearly nine times as on March 31 to just below eight times over the next one year.

"This underscores the importance of further asset sales. We believe, therefore, that the momentum of asset and stake sales will continue in the medium term," Gupta added.

As for how much corporate credit profiles would improve, CRISIL believes this will be a function of the amount of divestments and the sustainability of debt protection metrics.

)

)