High provisions, treasury losses may trim bank profits

However, better than their public sector peers, private banks such as ICICI, HDFC Bank, Axis will report lower profit growth thanks to rising macro challenges

Sheetal Agarwal Mumbai

For the quarter ended September, weak treasury incomes, rising asset quality pressures and margin contraction are likely to be the key trends in the banking sector. Consequently, leading private banks such as ICICI Bank, HDFC Bank and Axis Bank might see moderation in net profit growth.

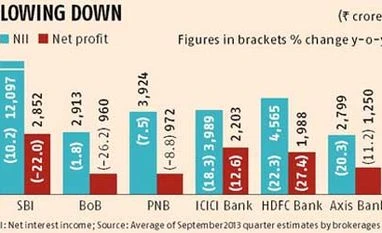

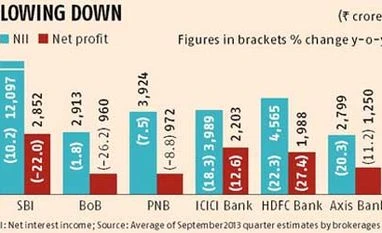

Analysts expect the net profits of these banks to rise 11.2-27.4 per cent. For the quarter ended June, ICICI Bank and Axis Bank had recorded net profit growth of 25.3 per cent and 22.1 per cent, respectively. HDFC Bank’s net profit rose 30 per cent in the June quarter. For these banks, the growth in net profit in the September quarter could be the lowest in the past three-four quarters.

In contrast, the leading public sector banks — State Bank of India, Bank of Baroda and Punjab National Bank — are expected to record net profit growth of 8.8-26.2 per cent.

“Private banks, which have been holding on to an earnings performance within their guided range and better-than-expected levels, are likely to feel the pinch of current macro headwinds — pressure on net interest margins (NIMs), moderating credit growth forecasts, lower fee incomes and modest treasury profits,” says Nilesh Parikh, banking analyst at Edelweiss Securities.

For most banks, NIMs are likely to be under pressure, given the higher wholesale rates and limit on repo borrowings. Banks such as YES Bank, IndusInd Bank, ING Vysya, Oriental Bank of Commerce, Andhra Bank and Canara Bank, which rely more on bulk deposits, would see a relatively higher impact compared to larger peers, analysts say.

“NIMs of banks are likely to decline due to sluggish lending yields and sticky deposit rates arising from the tight liquidity environment,” says Clyton Fernandes, banking analyst at Anand Rathi Securities. The recent rise in base rates, however, would provide some cushion to the margin contraction.

Treasury losses and lower third-party distribution incomes likely kept non-interest income growth subdued during the quarter. Rising yields (up 100-150 basis points in the quarter) would lead to treasury losses. Therefore, provisions on investments could also witness an increase during the quarter. But for relief from the Reserve Bank of India (measures such as transfer of investments to hold till maturity and spreading mark-to-market losses through three quarters), treasury losses would have been higher, analysts say.

For private banks, asset quality pressures are likely to remain high; these banks saw pressure on their commercial vehicle portfolios. Public sector banks could continue reporting higher slippages and restructuring.

“We expect credit costs to increase 40 per cent for private banks (three per cent for public banks), as we expect gradual deterioration from the low levels reported in the past. For public banks, slippages would broadly be in line with the previous quarter, but fresh restructuring is expected to remain high,” says M B Mahesh, banking analyst at Kotak Institutional Equities.

Driven by 18 per cent credit growth in the sector, private banks’ average net interest income (NII) growth is likely to remain strong at 20.3 per cent. Public sector banks could post muted NII growth at 6.5 per cent.

)

)