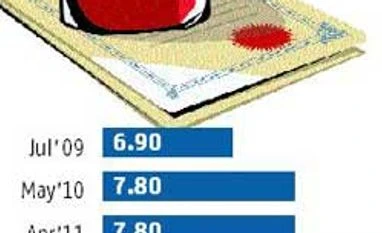

New 10-year bond issue may be about 7%

The govt said it would issue a new 10-year benchmark on Friday, as the existing one - with a coupon of 7.59% - has nearly exhausted its perceived limit, after raising Rs 87,000 cr through the instrume

Anup Roy Mumbai The new 10-year bond may be issued at around seven per cent, or lower — an indication rates in the economy have fallen to a multi-year low, even though banks are not passing on the rate benefit to their borrowers.

The government, on Monday, said it would issue a new 10-year benchmark on Friday, as the existing one — with a coupon of 7.59 per cent — has nearly exhausted its perceived limit, after raising Rs 87,000 crore through the instrument. The bond in question was issued on January 11 this year, the yield closed at 7.10 per cent. Coupon is the interest rate at which a bond is issued, while the present yield is the rate that the bond would fetch for an investor, if bought now.

However, the new benchmark 10-year paper is trading at 6.98 per cent in the ‘when-issued’ market, a kind of market where investors take advance positions, whereas the settlement happens after the bond is actually issued.

“Unless some negative development happens, the bond should get issued at around seven per cent, or lower,” said Devendra Dash, senior bond trader, DCB Bank.

If that happens, it would be a clear sign for the corporate sector to tap the bond market instead of heading for bank loans, given lenders are not passing rates despite Reserve Bank of India (RBI) prod. Banks are not in a position to compress margins, as they have to provide for credit costs, State Bank of India Chairman Arundhati Bhattacharya said at the annual convention of Indo-American Chambers of Commerce last week. At the same function, Union Bank of India Chairman Arun Tiwari said rates would fall by 25 basis points (bps) by the end of the financial year.

However, the fixed income market has followed RBI rate cuts much more closely and the 150-bp cut by the RBI since January 2015 has been fully passed.

RBI’s annual report released on Monday said the median base rate of banks declined by 60 bps, against a higher decline of 92 bps in median term deposit rates, “reflecting banks’ preference to protect profitability in the wake of deteriorating asset quality and higher provisioning.”

The weighted average lending rate (WALR) on fresh rupee loans declined by 100 bps (up to June 2016), significantly more than the decline of 65 bps in WALR on outstanding rupee loans, RBI’s annual report said. Companies, as a result, have shifted to the bond market route, even as capacity utilisation remained static.

“The capex cycle remains weak and private investment activity is listless,” RBI said. But economic activity is picking up, and RBI estimates the economy to register growth of 7.6 per cent in 2016-17, up from 7.2 per cent last year.

)

)