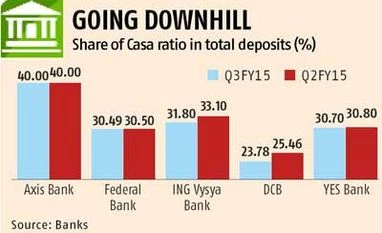

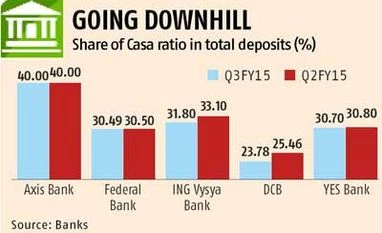

Private banks' low cost deposit share dips in Q3

Festive season cash demand, current a/c deposit slowdown to blame

Somasroy ChakrabortyNupur Anand Kolkata/Mumbai The low-cost deposits of private banks came under pressure in the quarter ended December due to tepid growth in current account deposits and expansion of overall deposit base.

Most banks that announced their Q3 FY15 results have reported either flat or marginal decline in their current account and savings account (Casa) deposits ratio. Casa are low-cost deposits that help banks keep their margins stable.

ICICI Bank and HDFC Bank are yet to announce their Q3 results.

“There has been some pressure on the Casa front but I believe it is only cyclical. In the third quarter, there is some outflow of cash from the savings account because it is the festive season,” said Jairam Sridharan, head — payments and lending, Axis Bank.

Banks also claimed that with deposit rates trending downwards, depositors had been shifting the money from savings account to fixed deposits. Some banks had started making changes in different maturities in deposit rates in the December quarter.

Explaining the development, Nitin Kumar, a banking analyst with Prabhudas Lilladher, said, “The daily average Casa balance has been stable for private banks, as they have been gaining market share from public sector banks. But now, private banks are also focusing on raising term deposits to support their balance sheet growth. Also, there is some opportunistic shift (from Casa to term deposits) as interest rates are expected to fall.”

Private sector lenders have been eating away at the market share of their public sector counterparts by offering better customer service, product innovation and branch expansion. These banks have seen their net interest margins remain either flat or come under pressure on a sequential basis in the third quarter, as the share of Casa in overall deposits came down.

“The Casa ratio has declined because our balance sheet growth has been faster than the growth in low-cost deposits. Our customer deposits have increased by 37 per cent. As a result, the share of Casa in total deposits has come down. But there is still growth of around 18 per cent in our Casa deposits. We expect the Casa ratio to return to 25 per cent in the next three years,” said Murali Natrajan, managing director and chief executive officer, DCB Bank.

Another reason for the muted growth in Casa as part of total deposits has been the slow growth in the corporate sector. With investments not picking up in several sectors, bankers claim the quantum of money being kept in current accounts by corporates has been fluctuating, hitting growth.

Credit demand has been decelerating and loans grew at its slowest pace in a decade in September quarter last year.

According to the latest data of the Reserve Bank of India, by year-on-year growth in bank credit was 0.7 per cent as on January 9.

Share of Casa ratio in total deposits (%)

)

)