State-run banks ahead in PoS deployment

Share of the state-owned banks in the PoS market has also increased from 26% in 2014 to 33% this year

Nupur Anand Mumbai Public sector banks (PSBs) have started getting more aggressive in point-of-sale deployments, eating into the share of private banks.

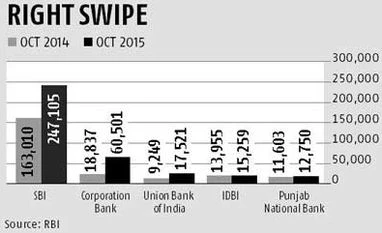

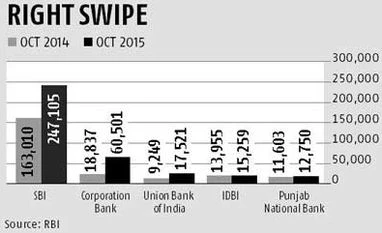

According to data by Worldline, a player in payments and transactional services, PSBs led by State Bank of India have accounted for almost 70 per cent of new terminals deployed in 2015 (till October). The report also stated that with increased penetration, the share of state-owned banks in the point-of-sale (PoS) market has also increased from 26 per cent in 2014 to 33 per cent this year.

This comes at a time when PSBs have been losing market share to private banks on several other fronts - deposits, advances and card spends, among others.

SBI, which increased the number of PoS to 0.24 million in Oct 2015 (according to latest data) from 0.016 million in the year-ago period, said the growth was being led by a growing need for alternate channels. “There is a need to build alternate delivery channels led by a need to improve financial inclusion and also to ensure that the customers have another option available with them. Moreover, there is a greater focus on increasing electronic transactions and that has led to growth,” said Mrityunjay Mohapatra, Deputy Managing Director & Chief Information Officer, SBI.

Experts said the government's focus on reducing cash transactions in the economy was also one of the reasons that had led to an increased focus by PSBs on improving infrastructure for card acceptance.

“The number of debit card in the system has increased significantly, especially due to the Pradhan Mantri Jan Dhan Yojana Scheme,” said Deepak Chandani, CEO (South Asia and Middle-East), Worldline. “This has been mainly led by the public sector banks and, therefore, once you issue the cards, the banks also have to ensure that there is infrastructure for better card acceptance. Moreover, the government has also been trying to move towards a cashless economy and that has also helped in the growth of alternate channels.”

A Boston Consulting Group report of 2013-14 said the number of cash transactions in the economy was 26 per cent; cheque transactions were 19 per cent. Another 37 per cent transactions were through ATMs or cash deposit machines. Transfers through electronic clearance system was three per cent; National Electronic Funds Transfer/Real-Time Gross Settlement Systems use was four per cent. PoS accounted for five per cent and transactions through the internet were six per cent.

Experts said the cost effectiveness of deploying PoS machines was another factor attracting banks. For instance, setting up a PoS would cost Rs 5,000-10,000. Setting up an ATM would cost Rs 3,00,000-5,00,000.

)

)