Rupee seen weakening further due to Greece crisis concerns

Bond yields close to 2-week high

Neelasri Barman Mumbai The rupee could breach 64 anytime, probably as early as Tuesday, due to concerns on the Greece crisis, said currency experts. Some experts also said the rupee was heading towards 65 a dollar, though they agreed currency depreciation would be gradual.

Though the Reserve Bank of India (RBI) was expected to arrest volatility, factors such as the US Federal Reserve’s tightening, the monsoon outlook and how the situation panned out in Greece would be the key factors that could impact the rupee. “Today (Monday), the Reserve Bank of India (RBI) had intervened in the market through state-run banks,” said Sandeep Gonsalves, forex consultant and dealer, Mecklai & Mecklai. “Tomorrow (Tuesday), the rupee may touch 64 a dollar and the broad trading range is seen between 63.75 and 64.25 per dollar.”

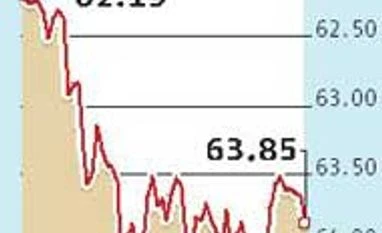

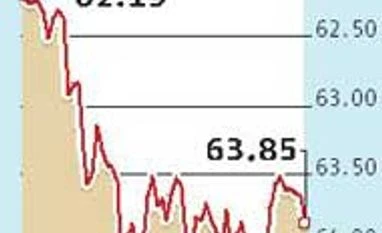

On Monday, the rupee opened at 63.84 and touched an intra-day low of 63.94 before closing at 63.85, compared with Friday’s close of 63.64 a dollar. The rupee ended near a level last seen two weeks ago, at 64.12. It was the biggest single-day drop for the rupee since June 8, when the currency had ended at 64.09 against the previous close of 63.76.

N S Venkatesh, executive director and head of treasury at IDBI Bank, said: “The rupee is still one of the best performing currencies among emerging market economies and this is due to the macroeconomic strength of the country. Today, the equity market did not perform well and this has been putting pressure on the rupee. There is also month-end dollar demand from importers. Besides that, there are some concerns due to the Greece crisis, as a result of which importers have started hedging their unhedged positions.”

In another development, government bond yields tracked losses in the rupee and rose on Monday. The 10-year benchmark bond closed at 8.06 per cent against Friday’s close of 8 per cent. The yield on this bond ended near a level last seen on June 16 at 8.08 per cent.

“Traders were seen selling bonds today due to the concerns pertaining to Greece. The appetite for bonds has come down. In fact, due to lower appetite, more bond auctions by RBI may get cancelled on Friday as on that day traders had quoted higher yields,” said a bond trader with a state-run bank.

On Friday RBI had cancelled the auction of three of the four government securities.

The Financial Stability and Development Council sub-committee report released last Thursday had warned India of the possible risks associated with the Greece debt crisis and the uncertainties lingering over the timing of rate increases by the US Fed.

Greece has ordered its banks closed for six days starting Tuesday to avoid a run on the nation’s lenders. The measures put Greece closest to an exit from the euro zone.

“The rupee is heading towards 65 per dollar. RBI will do its best to stem volatility in the rupee. The factors impacting the rupee includes the Greece situation, the export figures expected to be released, the monsoon scenario and US Fed's outlook on tightening,” said Suresh Nair, director, Admisi Forex India.

Meanwhile, tracking losses in the rupee government bond yields rose on Monday and the 10-year benchmark bond closed at 8.06 per cent compared with Friday's close of 8 per cent. The yield on this bond ended at a level last seen on June 16 at 8.08 per cent.

“Traders were seen selling bonds today due to concerns pertaining to Greece. The appetite for bonds has come down. In fact due to lower appetite more bond auction by RBI may get canceled like Friday as on that day traders had quoted higher yields,” said a bond trader with a state-run bank.

On Friday RBI had canceled the auction of three bonds out of the four government securities on auction.

)

)