Rupee strengthens marginally

Concerns of QE3 tapering still remain strong

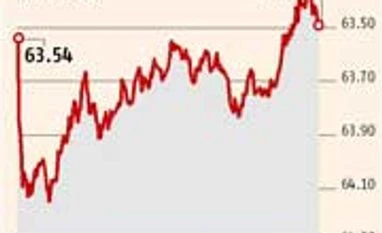

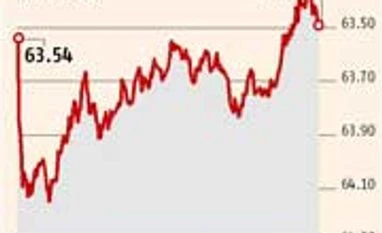

BS Reporter Mumbai The rupee improved marginally on Friday to close at 63.50 against the dollar, compared to the previous close of 63.54. According to currency dealers, the strengthening was because of dollar sale by state-run banks acting on behalf of the Reserve Bank of India (RBI).

The Indian currency had opened at 63.73 and, during intra-day trades, touched a high of Rs 63.37 and a low of 64.18 against the greenback. The rupee breached the 64-a-dollar mark due to dollar demand by importers and defence-related payments.

Despite the rupee ending strong on Friday, the Street was concerned about the outcome of next week’s Federal Open Market Committee (FOMC) meeting. The Street has factored in tapering of the third round of stimulus programme in the US, known as quantitative easing (QE3), at Rs $10-15 billion. However, if there is anything beyond that, the rupee is set to fall against the dollar.

“If the FOMC hints at a higher tapering than what the market has factored in, then it will create an issue. The market has factored in a tapering to the extent of $10-15 billion from October onwards. We also need to see if they are tapering US treasury or mortgage-backed securities. If the tapering is limited to US treasury, the market may not have major issues,” said N S Venkatesh, chief general manager and head of treasury, IDBI Bank and chairman of Fixed Income Money Market and Derivatives Association of India.

RBI believes that the move to offer a window to banks to swap fresh Foreign Currency Non-Resident (Banks) dollar funds and banks’ overseas borrowing limit of unimpaired Tier-I capital raised to 100 per cent, from 50 per cent earlier, will help attract dollar inflows into the country.

Some experts, however, differ. According to Partha Bhattacharya, deputy CEO of Mecklai Financial, RBI’s move may not attract flows as expected owing to high cost of post swap rupee resources. The Street is also concerned that once the month-end dollar demand by importers begin, the rupee will again be under pressure. Last month, the rupee had touched an all-time low of 68.85 against the dollar because of the same reason.

Meanwhile, tracking the marginal strengthening in the rupee, government bond yields fell. The yield on the 10-year benchmark government bond 7.16 per cent 2023 ended at 8.49 per cent, compared to the previous close of 8.50 per cent.

)

)