“There’s a lack of confidence in the reforms and the overall policy agenda, and that’s been spoken about underpinning the whole market sentiment and animal spirits so far,” Catherine Yeung, investment director at Fidelity International, said about investors’ reconsideration.

The skittishness spilled into Asia Wednesday. Japan’s Nikkei 225 Stock Average fell 2.1% to 19183.27, erasing all its gains for the year. The yen strengthened to as much as ¥111.4350 to the dollar; a strong yen typically hurts the earnings of Japanese exporters. Shares also struggled in Hong Kong, with Chinese companies particularly hard hit.

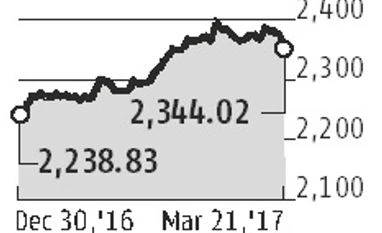

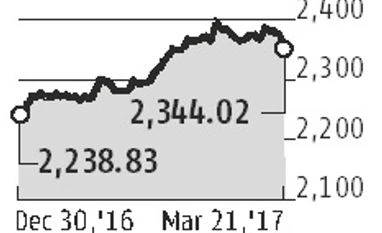

Increasingly, investors are showing they believe the Trump trade has got out of hand. Around one-third of portfolio managers believe global equities are overvalued, the highest level on record going back to the turn of the century, according to Bank of America Merrill Lynch’s monthly survey of 200 funds managing $592 billion, and around four-fifths believe U.S. stocks are the most overvalued of all. Around a third believe the U.S. dollar is overvalued, the highest level since June 2006.

The “Trump Lite” trade hinges upon the administration’s getting sandbagged in policy fights, such as the current wrangling over health care. Drawn-out congressional debates over the details of stimulus measures could cause inflation to peter out, encouraging investors to resume the hunt for yield—buying bonds and stocks with sustainable dividend income.

From the start the market had been too optimistic about Donald Trump’s ability to execute the finer details of his economic policy, said Megan E. Greene, chief economist at Manulife Asset Management.

“The risks were always going to become more balanced in the markets as it became apparent how aggressive and difficult the administration’s policy agenda is this year, with limited legislative days remaining in the calendar,” she said. “There is little doubt some stimulus will come through, but it is likely to be smaller and take longer to hit the real economy than many investors would like to believe.”

But if Mr. Trump’s current woes are bolstering emerging markets, he still has wide scope to spoil the party, particularly by pushing on his campaign pledges to get tough on the U.S.’s trade partners.

“The market seems to have forgotten about the rhetoric Trump has talked about regarding trade,” said Fidelity’s Ms. Yeung.

Source: The Wall Street Journal

)

)