When Snap listed its shares on the New York Stock Exchange in March, the floor of the exchange was festooned in the company’s signature yellow. Family members of Snap executives posed for photographs; some wore the company’s video-recording Spectacles. And as Snap’s two 20-something founders rang the opening bell, the crowd — including one of the founder’s fathers and a supermodel fiancée — applauded.

Yet just two months into its life as a public company, Snap’s celebration may already be ending.

On Wednesday, Snap, the parent of the messaging app Snapchat, reported earnings that missed Wall Street expectations in almost every regard. Not only did Snap record a $2.2 billion loss for the first quarter, its revenue was lighter than expected, and the company disclosed that its user growth was decelerating sharply. Investors punished the company, sending its stock down more than 25 per cent in after-hours trading.

The results represented a bumpy start for Snap after its much-celebrated initial public offering, the biggest for a technology company in recent years. Snap’s earnings illustrate how difficult it is for smaller social media companies to compete in the age of Facebook, the social network run by Mark Zuckerberg, which has sucked up more than two billion people worldwide and has made the size of its network a primary selling point.

For Snap, the challenge is tricky because the company approaches social networking differently. Instead of emphasising the number of people users know, Snapchat focuses on fewer connections and the quality of friends on the network. Yet with Wall Street and others using Facebook as a benchmark, the comparisons for Snap are tough. For now, Snap looks more like Twitter, the social media service that has had rough times because of anemic user growth.

Snap’s weak results so soon after its IPO appeared to shock many — even though it had warned investors that owning Snap stock would not be an easy path to riches. In its IPO. filing, Snap had highlighted slowing growth and huge losses that were not expected to end. Snap’s executives had cautioned that results would be “lumpy and unpredictable.”

Evan Spiegel, Snap’s chief executive, had said, “One of the challenges we’ve encountered over time is explaining to people why bigger isn’t better.”

But the excitement over a social media entity with young founders (Spiegel is 26; his co-founder, Bobby Murphy, is 28), an even younger user base and quirky digital advertising products had drowned out those warnings.

“They told us all of this,” Brian Wieser, an analyst at Pivotal Research, said of Snap’s executives. “With Snap in particular, there’s always been a greater fool element — a lot of people bought it because they thought someone else would pay more for it. That’s impossible to ignore.”

Snap’s $2.2 billion loss for the first quarter, which included a $2 billion expense related to stock compensation, was far above its $104 million loss a year ago. Revenue was $149.6 million, almost four times as much as a year ago, but fell short of Wall Street estimates of $158.6 million.

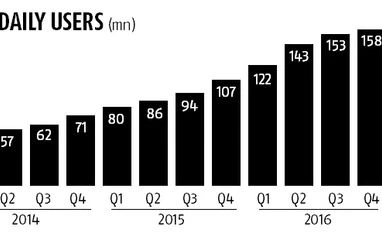

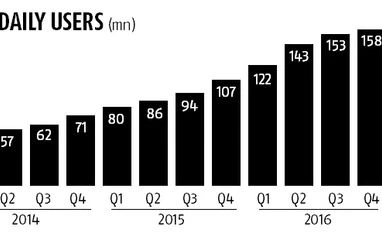

And while Snap said its number of daily users had increased to 166 million in the first quarter, up 36 per cent from a year ago, that was down from 53 per cent growth in the first quarter of 2016.

)

)