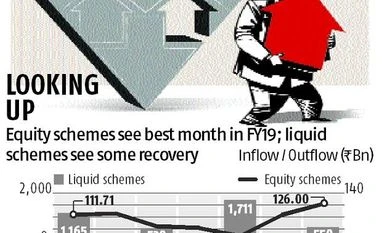

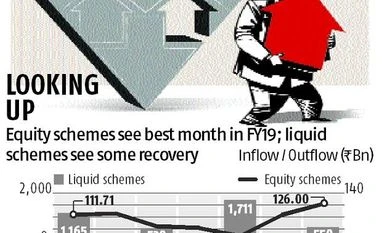

Equity mutual fund schemes continued to see strong inflows from investors despite a sharp correction in the markets in October. On the other hand, liquid schemes saw some recovery.

This category had seen its worst monthly redemptions in over a decade amid fears of a spillover from the IL&FS default.

After seeing an outflow of Rs 2.11 trillion in September, the category saw inflows of Rs 500 billion in October. However, these inflows are still one-third of what they were in August before IL&FS was downgraded several notches to default status.

While liquid schemes try to regain favour, equity schemes continue to scale new highs despite volatility in the equity market (see chart). The monthly data released by the Association of Mutual Funds in India (Amfi) shows that inflows into equity schemes in October stood at Rs 126 billion, making it the best month for equity schemes in FY19. If arbitrage schemes are taken into account, the tally stands at Rs 147 billion, making it the best month since March.

Industry players say liquid schemes can see a quick turnaround. “We expect the parity to return to liquid schemes by the end of this month. Investor concerns should subside as companies are meeting their repayment obligations. Also, we may see liquid scheme portfolios getting aligned to the investors' risk-appetite,” said Swarup Mohanty, chief executive officer of Mirae AMC.

While the mutual fund (MF) industry was anticipating meaningful outflows in September for advance tax payments, the large quantum of pullback came as a surprise. The pullback from liquid schemes accounted for more than eight per cent of the industry assets. The MF industry’s assets under management (AUM) shrunk from the Rs 25 trillion-milestone in August to Rs 22 trillion in September.

Industry officials said besides improvement in sentiment around non-banking financial companies (NBFCs), the money in liquid schemes could come back as a host of variables normalise.

“Liquidity had also dried up as the Reserve Bank of India (RBI) was intervening in the forex market by selling dollars and buying the rupee. Besides this, the cash circulating in the system had gone up due to the festive season,” Shastri said.

Meanwhile, income schemes continue to remain weak. This was the sixth month in a row where income schemes saw net outflows. Between May and October, the category has seen net outflow of around Rs 1.2 trillion with October seeing an outflow of Rs 376 billion.

)

)