Asian stocks head for 5-day drop on Fed concern

Bloomberg Asian stocks fell, with the benchmark index set for a fifth day of losses, after US equities slumped on concern over the end of the Federal Reserve's stimulatory bond-buying program. Japan's Topix index fell the most in almost seven months after the yen extended gains.

Honda Motor Co and Panasonic Corporation each fell at least 3.7 per cent to pace losses among Japanese exporters. OCI Co tumbled 5.5 per cent in Seoul, tracking losses among the world's biggest solar manufacturers amid concern Japanese demand for renewable energy will weaken. Wotif.com Holdings jumped 6.5 per cent in Sydney after regulators said they would allow Expedia Inc's bid for the online provider of hotel bookings.

The MSCI Asia Pacific Index slid one per cent to 138.47 as of 3:20 pm in Tokyo after retreating to a four-month low yesterday. The measure capped its biggest monthly drop in more than two years in September amid concern Chinese growth is slowing and that the Federal Reserve may increase US interest rates sooner as it ends asset purchases. U.S. stocks tumbled yesterday, sending the Russell 2000 Index into a correction.

"Wall Street sneezes and the rest of the markets react," said Chong Yoon-Chou, Singapore-based investment director at Aberdeen Asset Management Plc, in a Bloomberg Television interview. "It's probably time that the US takes a breather as we've had such a strong run. Hong Kong protests should blow over. It could hurt the domestic economy. We just have to watch these things." Hong Kong Chief Executive Leung Chun-ying faces a deadline from student leaders today to resign or see an escalation of pro-democracy protests that have choked city streets for nearly a week. Markets in Hong Kong remain closed today, while those in mainland China are shut through October 7.

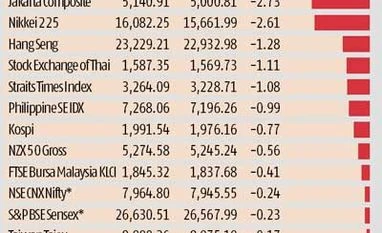

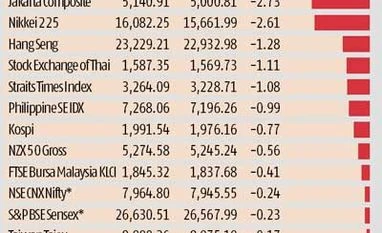

Japan's Topix index sank 2.9 per cent, the biggest decline since March, as the yen headed for a second day of advance. South Korea's Kospi index dropped 0.8 per cent to close at the lowest since June 23. Taiwan's Taiex index lost 0.2 per cent. Singapore's Straits Times Index and Australia's S&P/ASX 200 Index each fell 0.7 per cent, while New Zealand's NZX 50 Index slid 0.6 per cent. Indian markets are closed on Thursday and Friday.

Futures on the Standard & Poor's 500 Index were little changed. The measure lost 1.3 per cent yesterday to its lowest close since August 12. The Russell 2000 lost 1.5 per cent, extending losses to more than 10 percent from a record in March, meeting the definition of a correction.

More than $200 billion in assets was erased from US equity markets during the past three months, as stronger economic data fueled concern the Fed may raise interest rates sooner than anticipated. Hiring in the US accelerated for the first time in three months, according to a private report before monthly payrolls figures due tomorrow.

While US factories capped their strongest quarter in more than three years, a gauge of manufacturing for the 18-nation euro area pointed to near stagnation. The European Central Bank is expected to announce today details of its plan to buy asset- backed securities after it unveiled a series of stimulus measures to boost credit lending and combat the threat of deflation.

)

)