Attractive valuations key support for Coal India

While stake sale news and pressure on margins are worries for the stock, valuations are likely to limit downside

Jitendra Kumar Gupta Mumbai The Coal India Ltd (CIL) stock has fallen five per cent over the past week, after news that the government is selling a 10 per cent stake in the company. With investors and traders looking for the lower or discounted price during the stake sale process, the stock saw some selling pressure. However, analysts say the stake sale (and discount thereof) news is already factored in and further correction, if it happens, should be used for buying the stock.

"Fundamentally, we do not think the stock deserves a large correction it is largely because of technical factors led by the news of an FPO. However, in this case as well, we do not think the stock can fall further from the current levels because of valuations," said Misal Singh, who tracks the company at Religare Securities.

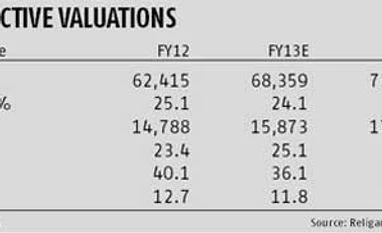

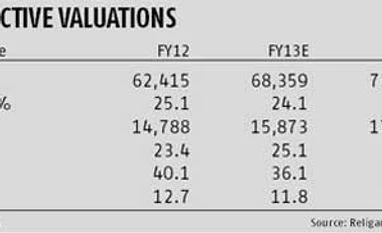

At current prices, the stock is trading at 11 times its FY14 estimated earnings, which could act as a key support to the prices, especially in the light of its sound business model.

CIL, which supplies almost 80 per cent of India's coal requirements is a debt-free company, generating 33 per cent return on equity, sitting on cash and cash equivalent of about Rs 65,000 crore (34 per cent of market capitalisation).

Stake sale The stock has corrected from around Rs 312 last week to Rs 297 per share currently. Most analysts believe the possibility of discount is already factored in the prices. The government is said to be looking to bring down its stake to 80 per cent, compared with 90 per cent currently. At current market prices, the stake sale could fetch around Rs 19,000 crore for the government. However, the stake sale could take some time, as analysts expect it to hit the market around August or September.

Lower expectations In the interim, the key thing to watch would be the growth in production and dispatches along with its ability to raise coal prices. In the past few months, analysts had lowered the price target, also a reason that the stock corrected from about Rs 370 in January to the current levels.

Rahul Modi of Antique Stock Broking says for every Rs 1 a litre increase in diesel prices, costs go up by Rs 120 crore. He expects the financial impact of recent increase in diesel prices to be in the region of about Rs 2,000 crore in FY14. That apart, CIL recently raised the wages of its employees, thus impacting the cost by around Rs 250 crore per year. The combined increase in cost is four-five per cent of realisation (Rs 1,232 a tonne) it gets on coal supplied under the fuel supply agreement.

In this situation a hike in price and or higher supplies are the two key things that could help absorb higher costs.

"We do not expect a commensurate increase in coal prices as, in our view, the downstream sector (power distribution utilities) is under stress, even after the current round of power tariff increases," says Misal Singh of Religare.

In case of dispatches also, analysts believe that there is a bottleneck in terms of availability of railway rakes, especially in the light of commencement of iron ore mining in Karnataka.

Analysts believe that if the company is not able to raise supplies and prices, margins could come down in the near term. No wonder earnings in FY14 are expected to grow at just six-seven per cent. However, even at such low earnings growth the company will generate over Rs 25,000 crore cash from operations which is 13 per cent of the company's market capitalisation. This is why the Street believes that there is less scope for correction in its share prices.

)

)