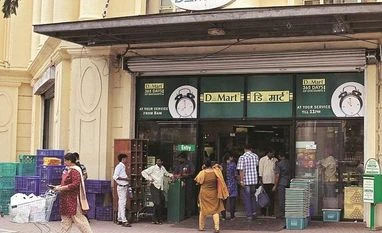

Avenue Supermarts', owner of hypermarket chain DMart in the country, market capitalsation (m-cap) crossed Rs 1.5 trillion-mark on the BSE on Monday, after its stock price hit a new high of Rs 2,391, up 4.6 per cent in the intra-day deals.

At 12:44 pm, Avenue Supermarts was trading 4.4 per cent higher at Rs 2,387 with a m-cap of Rs 1,49,825 crore, the BSE data shows.

The stock has surpassed its previous high of Rs 2,361, recorded on February 6, 2020. That apart, Avenue Supermarts has outpaced the market by gaining 34 per cent in the past five weeks, and is decisively trading above its recent low of Rs 1,790 hit on January 1, 2020. In comparison, the S&P BSE Sensex was up 0.56 per cent during the same period.

The stock overtook NTPC, Indian Oil Corporation (IOCL), Coal India, UltraTech Cement and HDFC Life Insurance Company in the past five weeks to stand at number 20th position in the overall market capitalisation ranking.

The operations committee of the board of the directors of Avenue Supermarts is scheduled to meet today, February 10, 2020 to consider and approve the issue price, including a discount, if any, for the equity shares to be issued, pursuant to the qualified institutional placement (QIP) issue.

Last month, the company had informed the stock exchanges that it intended to launch a QIP by offering 20 million equity shares at Rs 1,999.04 per share.

The QIP, which is expected to garner Rs 4,000 crore, will help the promoters of the company, led by Radhakishan Damani, pare their holdings, which currently stands at 79.73 per cent.

"Avenue Supermarts proposes to utilise the net proceeds to augment long-term resources for financing its future expansion plans, which include funding expenditure towards implementation of strategy on expanding store network and increasing the efficiency of supply chain network, including warehousing facilities and related acquisition of land, general corporate purposes and other corporate exigencies, including but not limited to, refurbishment and renovation of existing stores, working capital requirements and strategic investments/ acquisitions," it said in a statement. The company also said funds will be used for repaying/ prepaying a part of our outstanding indebtedness.

)