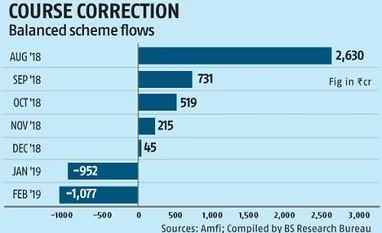

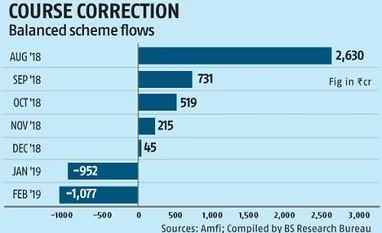

Balanced schemes, which invest in both equities and debt, are facing redemption pressure amid low dividend payouts and weak returns. In February, the category saw outflows of Rs 1,077 crore, taking their two-month net redemptions tally past Rs 2,000 crore.

Industry players say more money could flow out of these schemes. “The balanced schemes are likely to remain under pressure given the lower dividend payouts. Some schemes in the category have given negative returns. This has taken investors by surprise,’’ said Aashish Somaiyaa, MD & CEO, Motilal Oswal Mutual Fund (MF).

Within balanced schemes, the dividend option was a big draw for investors. However, the introduction of dividend distribution tax (DDT) and long-term capital gains tax on equity schemes have dimmed their appeal. “The imposition of dividend tax and poor market performance have hurt the sentiment around balanced schemes. Once the market performance improves, these schemes could see a revival,” said Radhika Gupta, CEO of Edelweiss MF.

Balanced schemes were one of the fastest growing categories in recent years. At the start of 2017, the assets under management (AUM) for this category was just Rs 64,954 crore. Since then, the assets have increased nearly three-fold to Rs 1.73 trillion.

“The category grew a lot in terms of AUM, but the product has lost its appeal among investors looking for regular income. We could see asset size moderating. However, gross inflows will still continue,” said Chandresh Nigam, MD and CEO of Axis MF.

The sharp decline in investor interest can be gauged by the fall in net flows in this financial year. So far in 2018-19, balanced schemes have reported net inflows of Rs 10,000 crore, much lower than Rs 90,000 crore they had garnered in 2017-18.

Experts say regulatory changes and poor returns have made selling balanced schemes challenging. Earlier, only debt oriented schemes were levied DDT. Starting this fiscal, the Centre introduced a 10 per cent tax on dividends paid by equity-oriented mutual fund schemes. Most balanced schemes fall under this category for taxation purpose. Also, balanced schemes were being mis-sold by some as tax-free schemes before the imposition of DDT.

“As dividends received from balanced schemes were not charged under DDT, they were wrongly being marketed as tax-free income products. However, with DDT being extended to equity schemes, instances of mis-selling have reduced,” said an advisor.

These schemes have been at the receiving end of volatility in both the equity and debt markets as these are hybrid products. The poor performance of late has made it difficult for these schemes to keep declaring dividends.

The average six-month returns for top hybrid schemes is a negative 3 per cent, while the one year returns is 2.4 per cent, data show. “While these schemes are positioned as less risky due to their debt component, of late debt has been an additional source of burden, said a fund manager.

)

)