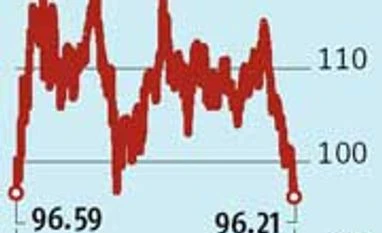

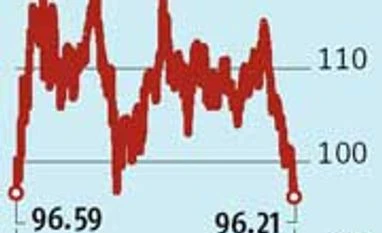

Brent crude falls to 26-month low of $96.21 on Chinese data

Bloomberg London Brent crude declined to its lowest intra-day level in more than two years as China's industrial output expanded at the weakest pace since the global financial crisis. West Texas Intermediate also fell.

Futures slid as much as 0.9 per cent in London. Factory production in China, the world's second-biggest oil consumer, rose 6.9 per cent from a year earlier in August, the National Bureau of Statistics said September 13, compared with nine per cent in July and a median estimate of 8.8 per cent in a Bloomberg News survey. Crude output in Libya increased to 870,000 barrels a day, according to state-run National Oil Corp.

The Chinese data "is one of the main weak sides of the market," Andy Sommer, an analyst at Axpo Trading AG in Dietikon, Switzerland, said by phone. "This weak data can mean the certainty, or confidence, in their expected growth is declining more and more. Currently the market is on the bearish side." Brent for October settlement, which expires on Monday, fell as much as 90 cents to $96.21 a barrel, the lowest since July 2, 2012, on the London-based ICE Futures Europe exchange. It traded 54 cents lower at $96.57 as of 1:17 pm local time. The more- active November contract slid 40 cents to $97.56. The European benchmark crude was at a premium of $5.15 to WTI, having settled at $4.84 on September 12.

WTI for October delivery dropped as much as $1.64 to $90.63 a barrel in electronic trading on the New York Mercantile Exchange. Front-month futures are set for the lowest close since May 2013. The volume of all futures traded was 74 per cent higher than the 100-day average for the time of day. Prices slid 1.1 per cent last week and have decreased seven per cent this year.

Growth lull

Factory output in China grew at the slowest single-month pace since December 2008, excluding the Lunar New Year holiday period of January and February, based on previously reported figures compiled by Bloomberg. China will account for about 11 per cent of global oil demand this year, compared with 21 per cent for the US, according to the International Energy Agency.

"We are concerned about a sharp slowdown in China," Ashley Davies, a strategist at Commerzbank AG in Singapore, said by e-mail. "The pronounced weakness in industrial production has come earlier than expected." Islamic State US allies signaled readiness to step up the fight against the Islamic State under a coalition formed by President Barack Obama as the beheading of a British aid worker sparked further outrage. The conflict in Iraq, the second-biggest member of the Organization of Petroleum Exporting Countries, has spared oil facilities in the south, home to about three-quarters of its crude output.

Output from Libya, which is rising after more than a year of political unrest, was 870,000 barrels a day, National Oil Corp. spokesman Mohamed Elharari said on Sunday. A single rocket fell on the site of the Zawiya refinery which wasn't damaged and continues to operate, Mansur Abdallah, director of oil movement at the refinery, said on Monday.

)

)