Cement stocks lose gains post robust rally in April

Upcoming monsoon and continuous poor prices rein in the rally in cement shares

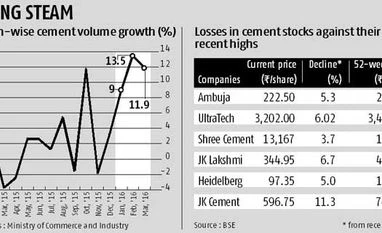

Chandan Kishore Kant Mumbai Cement stocks, in the limelight in April after good volume growth numbers in the quarter ended March, have lost steam and cracked by three to 11 per cent since.

With a forecast of an above-normal monsoon to hit the peninsula in two weeks, amid subdued cement prices, shares of companies in the segment are likely to come under pressure in the short term, say market participants.

January-March saw average growth of 11.5 per cent, highest for any quarter in almost four years for the 410 million tonne industry. Cement stocks had reacted positively to this and market experts were quick to give a 'buy' call on the space. For instance, shares of Birla's UltraTech had touched a high of Rs 3,407 in April.

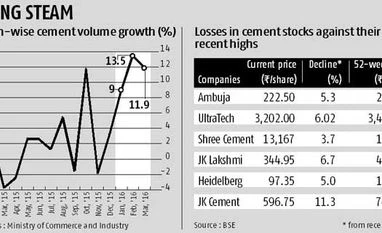

However, it is currently trading at Rs 3,202, down five per cent since. Similarly, stocks of Ambuja Cements are down five per cent to Rs 222, against their April high of Rs 235. Shares of Shree Cement lost 3.7 per cent, JK Lakshmi dipped 6.7 per cent, Heidelberg Cement declined five per cent and JK Cement lost 11 per cent.

One also needs to note that one factor helping in the high double-digit growth of the March quarter was last year’s poor base. In January-March of 2015, industry volumes had fallen by 0.5 per cent.

Further, cement makers' net realisations on a per tonne basis could not improve to the same extent, given the poor prices. In absolute terms, the all-India average price for a 50 kg bag moved up from Rs 271 in January to Rs 285 in April, up five per cent. However, year-on-year, prices had weakened; in April 2015, it was Rs 289 for a bag.

This led to less of realisations. For example, UltraTech, the country’s largest maker, had a seven per cent decline in net realisation on a per tonne basis, despite 15 per cent growth in sales volume. ACC reported a 9.3 per cent rise in sales volume but its realisation dropped eight per cent.

Shares of all cement companies are trading at a significant discount to their 52-week highs. This suggests the industry isn't out of the woods and the March quarter numbers could turn out to be an aberration.

Currently, capacity utilisation is around 70 per cent. With lesser capacity additions in the next few years, experts feel utilisation will improve and demand will outpace the supply in due course, auguring well for cement stocks.

Ambareesh Baliga, an independent expert, says: “Cement stocks are buys. There are hardly any capacity additions in the coming years and with expected rise in demand, there is room for these stocks to go up from here. During rains, they might soften, a yearly phenomenon, but these would be buying times for investors.”

A good monsoon actually tends to boost cement offtake in the rural and semi-urban regions, with a four to six months' lag. After the monsoon and harvest seasons during the festive months, construction activities enter a peak phase from November till May every year.

)

)