Challenges continue for ACC

Both net sales and Ebitda for the March quarter were lower than Street estimates

Ujjval Jauhari Mumbai After bearing the brunt of lower demand and realisation in calendar year 2013, new financial year 2014 hasn’t started on a significantly different note for ACC. Historically, the March quarter is better than the December quarter. And, this trend is also visible in ACC’s performance for quarter ending March 2014 wherein demand and realisation in some regions (North and West) was much better (sequentially). But, on a year-on-year basis, the performance for the March quarter was weak and came lower than the street expectations, especially on the operating front. With the environment and outlook still subdued, analysts remain bearish on the stock, which has seen a run-up recently along with other cement stocks.

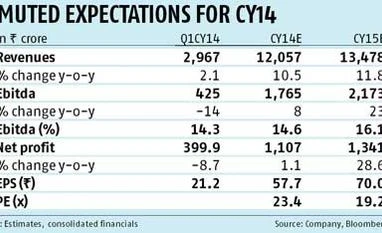

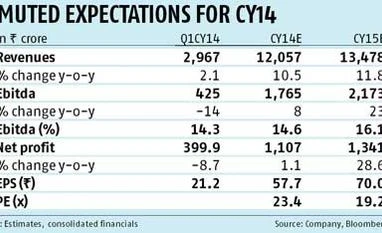

On a consolidated basis, while analysts polled by Bloomberg estimated net sales to come at Rs 3,088 crore, it came at Rs 2,967 crore. The Ebitda at Rs 425 crore, too, was lower than estimates of Rs 434 crore. While ACC reported net profit of Rs 400 crore, adjusting for Rs 113 crore tax write-back it would have come at Rs 287 crore. While net profit is higher than Rs 277 crore estimated by the market, part of the outperformance can be attributed to higher other income as well as other operating income.

The company’s net sales during the quarter at Rs 2,967 crore were up by a marginal two per cent year-on-year. Escalating manufacturing expenses due to increase in costs of major inputs such as coal, fly ash and gypsum and the impact of higher railway freight and diesel price rises impacted operating profits. Ebitda at Rs 425 crore came lower than Rs 492 crore clocked in the year ago period. As a result, Ebitda margins fell 260 basis points year-on-year to 14.3 per cent compared to 16.9 per cent in the March 2013 quarter. The reported net profit (including tax write-back) at Rs 399 crore was lower than Rs 438 crore in the year-ago quarter. Last year, too, ACC had seen a tax write-back of Rs 141 crore.

In the past two months, stocks of leading cement companies have seen strong run up on the bourses. This has been in anticipation of better demand and realisations as the seasonally strong season for cement started. Certain plant closures in North India lead to sharp uptick in cement prices in the region. This boosted the sentiment further. Thus, ACC’s share price too saw a good run-up on the bourses touching 52-week high of 1,402.35 on April 10.

However, the market seems to be factoring in much stronger demand and realisations which is not the case currently. For the all-India players, the soft demand and realisations in South India and limited uptick in East and Central India has impacted performance. The same is evident from volumes growth being posted by cement players like ACC. The company saw its sales volumes at 6.48 million tonnes (mt) during the March quarter, marginally higher than 6.42 mt in the March 2013 quarter. This is despite the low base in the year-ago quarter, wherein volumes had fallen five per cent. ACC itself does not foresee much demand growth as is evident from its results release, which says “While we do not foresee any significant improvement in the cement market in the near term, we will continue to drive our cost leadership and customer excellence programmes to enhance sales realisations and improve margins”. While analysts believe demand could get a push once a new government comes into power, the same is only likely to happen after the monsoon. Thus, it is only the last quarter of calendar year 2014 which can see some significant uptick in demand. As a result analysts are not expecting significant gains in profits for CY14.

The cement report of April 4 by Citi Research says, “We believe market is pricing in a more optimistic scenario than what is perhaps likely.” They add that cement stocks have rallied on hope, but we believe the market is now pricing in a very optimistic scenario - even if demand recovers in line with the average gross domestic product multiplier.

Analysts at Deutsche Bank had said that ACC and Ambuja Cements are clearly emerging as pure pricing plays and hence given their recent outperformance, we retain ‘Hold’ (rating on their stocks). The same is reflected in consensus target price as per Bloomberg which stands at Rs 1,248 meaning that at current price of Rs 1,348 the stock’s valuations remain stretched.

)

)