Cipla one-offs impact Q3 results

Sticks to margin forecast for FY16; analysts believe long-term story looks good

)

Explore Business Standard

Sticks to margin forecast for FY16; analysts believe long-term story looks good

)

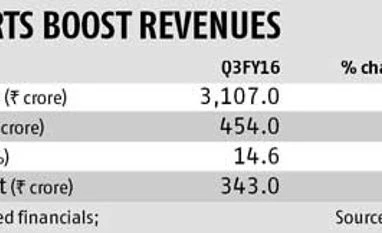

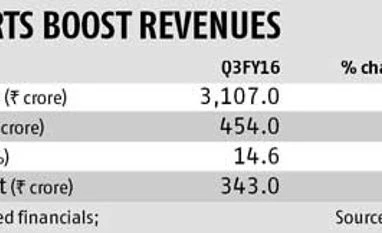

Cipla's reported December quarter topline as well as net profit were below Street expectations. The reason for the miss on the topline, which grew by 12.3% year-on-year, has been the India business (38% of consolidated revenues) where revenue fell by 0.4% impacted by a one-time policy change in its distribution system.

Adjusted for this, growth at the consolidated level would have been 17% while India revenues would have grown by 13%. For the December quarter, company's domestic retail sales, as reported by IMS, were up 18% as against industry growth of 16%. Cipla continues to be the third largest player in the domestic pharma space with a market share of 5.2%.

The one-time distribution change as well as currency headwinds also impacted its consolidated operating profit margins, which at 14.6% contracted 540 basis points year-on-year. Adjusted for the changes, margins according to the company would have been about 18%.

Going ahead, the company indicated that margins would be in the 17-18% range. Cipla also said that it is on track to meet the 100 basis point gain in operating profit margins for FY16 from the FY15 level of 19%, all of which provide comfort.

Given the focus on the US market, Cipla has increased its R&D expenditure as a percentage of sales from 6% a year ago to 8% now. The company is looking at 3-4 filings per quarter in the US (20 over the next one year) and expects FY17 to see good traction in the world's largest healthcare market.

Some of the filings (65-70 in total) could include first-to-files which may translate into higher revenues and margins. In addition to the R&D, Cipla has also indicated that it will increase investments in consumer healthcare and biologics businesses.

The key performer for the company has been exports (59% of consolidated topline), revenues from which grew by 28% year-on-year. The growth was driven by its South Africa business and other emerging markets. Revenues from South Africa business grew by over 20% year-on-year and about 43% for the nine months ended December 2015.

Both the private healthcare as well as the tender business (about a third of South African revenues) did well with growth in the former being driven by the licensing deal with Teva as well as the strong respiratory portfolio. Barring the one-offs, the results are inline and given the expansion plans and product pipeline, Cipla's long-term story looks good.

First Published: Feb 10 2016 | 10:27 PM IST