Commodity prices on upswing as investors return

US rate hike will drive investors to bonds

Rajesh Bhayani Mumbai

International commodity markets have rallied since April with elevated prices of metals, crude oil and farm produce on the US’ reluctance to raising interest rates since December.

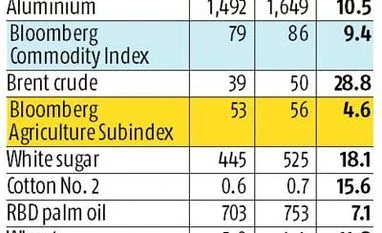

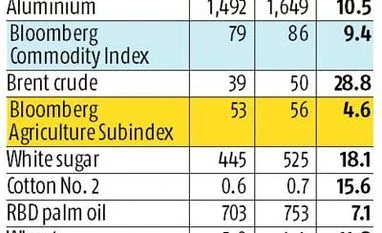

The Bloomberg all-commodity index is up 9.4 per cent since April, the London Metal Exchange’s metal index is up 6.3 per cent and Bloomberg’s farm index is up 4.6 per cent. Crude oil has recovered sharply on talks of a production freeze, metals are up on reports of production cuts, and El Niño is driving up prices of farm produce.

Following global rally in metal prices, BSE metal index has also rallied since April by 33.69 per cent to 10,080.83 points, compared with 10.43 per cent rise in Sensex during the same period.

“A second rate hike by the US Fed was delayed over weak economic data. Brexit also nudged investors to push money into commodities supported by production cuts,” said Gnanasekar Thiagarajan, director, Commtrendz Research.

India and China have contributed to the rally. The two countries have been storing crude oil at lower prices. El Niño and drought in India have lowered farm exports. China is continuing metal production cuts.

Zinc outperformed among metals as the Philippines suspended operations at two mines over environmental violations, taking the total of closed mines to 10.

Crude oil has been moving in the $40-50 band because production freeze concerns emerge at the lower end and supplies increase at the higher end as some fields turn viable. The OPEC is meeting to review its production strategy in September and crude oil is expected to remain firm till then.

Oil prices slipped on Monday by 2.26 per cent to $48.76 from Friday’s close of 49.89 on a stronger dollar and expectations of increased production.

The delayed rate hike by the US Federal Reserve, which has drawn financial investors to commodities, could end the rally when it does occur.

Kunal Shah, head of commodities research at Nirmal Bang Commodities, said the rally could stall for another reason. “July has been a bad month for China. Industrial production, private fixed asset investment, and investment growth in state-owned enterprises have all fallen.”

Minutes of a Federal Reserve meeting released last week also indicated an interest rate hike could occur earlier than expected, soon after the US election. “The rate-hike headwind will remain over commodities,” said Thiagarajan. He added a US rate hike would drive investors to bonds and the market would keep adjusting prices to this possibility.

“Metals may consolidate and drift marginally lower, but we remain bullish on crude oil,” said Shah.

Farm prices will remain elevated except wheat, which has seen higher production. Sugar, coffee, cotton and edible oil will remain firm on tight global supply.

)

)