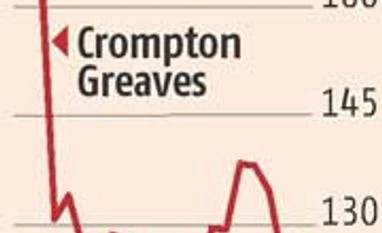

Contra buying emerges in Crompton Greaves

Joydeep GhoshRajesh BhayaniSamie Modak While a lot of brokers have given a 'sell' call on Crompton Greaves after its results on February 3, there seem to be several contrarian investors getting into the stock as well. The stock, which fell 21.7 per cent on results day, the highest since 2001, slipped only 1.03 per cent in the following 17 trading sessions. Market sources say after an institutional investor dumped the stock, buyers have emerged to lap it up at lower levels.

Hedge funds short rupee in offshore market Read more from our special coverage on "CROMPTON GREAVES"

While many domestic investors might be waiting for the Union Budget 2016-17 to get clues about the mood of foreign investors, market people say several hedge funds have already taken a bearish bet on the rupee in global markets. The target: Rs 70 a dollar. Their main worry is that even if the Budget is favourable, China is expected to devalue its currency further, as its efforts to stabilise the market by pumping in liquidity haven't worked so far.

IPO-bound firm eyes Budget for a boost Ahmedabad-based online retailer Infibeam, which is planning to raise Rs 500 crore from an initial public offering (IPO), is keenly eyeing the Budget 2016-17 for a possible boost in prospects, say sources. The e-commerce entity is setting up a 17-storey office in the Gujarat International Finance Tech-City (GIFT-City), a special economic zone. Sources say any tax break in the Budget for entities setting up shops in GIFT-City will improve investor appetite for the country's first e-commerce IPO.

)

)