D-St edgy on GDP & deficit numbers

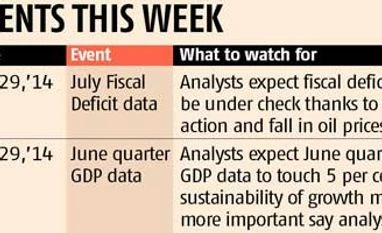

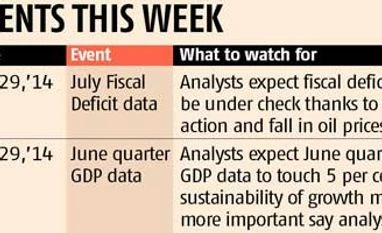

Sneha Padiyath Mumbai Domestic data is expected to keep the market nervous in the week ahead, which could see the July fiscal deficit numbers and quarterly gross domestic product (GDP) data being issued.

The fiscal deficit is the difference between what the government earns and what it spends. The GDP is a measure of the country's economic output. Analysts said while the broad market trend was that shares would likely remain up, any upset in the domestic figures could cause a dent in the market's current optimism.

"Macro data will be critical. Whether the recent uptick in the economic data is sustainable in equal fashion or not will be keenly watched by the participants. The exuberance in the market that started early this year has taken on a superlative dimension. So, investors will have to be cautious," said Dhananjay Sinha, co-head (institutional research), Emkay Global Financial Services.

The benchmark BSE Sensex and the National Stock Exchange's Nifty ended the week with gains of a little over one per cent. Both indices are held to be representative of how the market is doing.

The Sensex closed at 26,419 and the Nifty ended at 7,913. For the week ahead, analysts said the upside in the Nifty could be limited, with the benchmark index trading in the 7,800-8,200 range. Key support levels are expected at 7,860 with immediate resistance at 7,930, said technical analysis experts.

"Traders are advised to maintain a positive bias on Monday, as we expect the index to witness upside breakout from the prevailing range in the near future. At the same time, we have been noticing only selective counters are performing well these days, so keep extra caution in stock selection," said Jayant Manglik, president (retail distribution), Religare Securities.

The health care, information technology, automobile, auto ancillaries and banking sectors could be keenly wD-St edgy on GDP, deficit numbers

Health care, banking, auto stocks could continue uptrend this week, say analystsatched by participants for further outperformance, analysts said. Foreign institutional investors were net buyers for Rs 2,939 crore during the past week. The figure includes provisional exchange data for Friday.

Market experts believe flows are unlikely to get impacted by the rate-rise uncertainty in the United States because of an improving outlook in the global and domestic economy. They note the American central bank had begun to reduce the amount of capital it had been pumping money into the financial markets around three quarters earlier. However, foreign flows have not receded significantly.

Foreign portfolio flows have been about Rs 75,000 crore since the beginning of the calendar year.

)

)