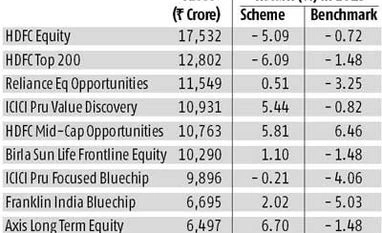

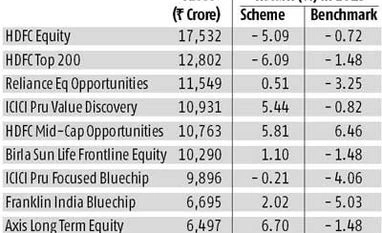

Equity MFs weather market volatility with positive returns

Seven of the 10 equity schemes made positive returns for investors and eight offered better returns than their respective benchmarks in 2015

Chandan Kishore Kant Mumbai India’s top 10 equity schemes did fairly well in a not-so-good-year for markets in 2015.

These schemes enjoy the faith of most retail (small) investors and control a little over a fourth of all equity assets managed by the Indian mutual fund (MF) sector.

Though none of these could beat the returns offered by banks’ fixed deposits, and only a few managed to match the inflation-beating return, fund managers, to a large extent, were able to protect investor capital in a year marked by deep corrections and steep volatility.

Their performance also defied the logic that a big size of funds is a constraint. Seven of the 10 made positive returns for investors and eight offered better returns than their respective benchmarks. In a year when the key stock indices were down about by five to 15 per cent from their all-time high.

Axis Long Term Equity Fund, Rs 6,500-crore in size, was the top gainer, with a return of 6.7 per cent. Followed by HDFC Mid-Cap Opportunities (5.8 per cent), ICICI Prudential Value Discovery (5.4 per cent) and Franklin India Prima Plus (4.4 per cent).

Kaustubh Belapurkar, director, fund research, at Morningstar India, says: “Two factors which really helped these giant schemes to do well was the expertise of active fund management among Indian fund managers and strong inflows from investors in equity schemes. The securites’ selection worked well this year and there were several non-benchmark stock picks which helped the schemes perform better in a dull year. Along with this, robust flows from domestic investors helped fund managers pump money in stocks smartly during corrections.”

However, the two largest equity schemes, HDFC Equity and HDFC Top 200, both managed by Prashant Jain, considered one of the best, have a negative return of five per cent and six per cent, respectively.

Both also hugely under-performed their benchmarks. Collectively, they manage assets worth Rs 33,300 crore or about eight per cent of the sector’s total equity assets.

“In (both) schemes, some of the securities by the fund manager have been a drag for some years now, which is affecting the performance. But, these funds have made handsome money for investors in the long term, which is how mutual funds should be. I think continuing with stocks like State Bank of India shows the fund manager’s conviction, which is part of his philosophy. Investors should give time to fund managers and not jump to a quick conclusion on short-term performance.”

ICICI Prudential Focused Bluechip Fund, managed by Manish Gunwani, is the third scheme in the largest category and turned marginally negative in the year. However, this nearly Rs 10,000-crore scheme did beat its benchmark by about 385 basis points.

According to Belapurkar, size cannot be the reason for under-performance of these schemes.

“It’s a myth that size is a constraint for performance. It’s stock selection and conviction of fund managers which matter. More, it is not worth it to judge these under-performing schemes from a year’s perspective.”

Currently, the total equity assets of the MF sector are a little over Rs 4 lakh crore, only four per cent of the total market cap of Rs 100 trillion. There are about 460 equity-oriented schemes for investors.

)

)