The world is readjusting to post-Brexit reality. Two big down-sessions have been followed by short-covering. Currency markets remain tense. Central bank stances will be critical to shaping sentiment.

The Indian markets saw a sharp downturn on Friday, followed by three sessions of relatively low volumes and short-covering. The Brexit overrides the consequences of Raghuram Rajan's exit. But, neither event will be good for the rupee, or India's trade in general.

Rajan's last policy review in early August will be eagerly awaited and his successor must hit the ground running. The rupee is very likely to move lower between September and December 2016, as the Reserve Bank of India unwinds a big bunch of swaps.

The Nifty found support well above the 200-Day Moving Average or 200-DMA (currently at around 7,750). We assume that the long-term trend has not broken down, yet. However, the last upmove ended at just below Nifty 8,300. The next upmove must neat 8,300 to maintain a higher-highs sequence.

Newsflow will continue to be the driver. There are many "known - unknowns" in the next six months, including the Brexit playout, a new US president, the potential for reboot of Indian reform, etc. All will be large events. Plus of course, there are possible "unknown-unknowns" like terrorist attacks, commodity supply disruptions, geopolitical face-offs, etc.

FIIs have continued with their strategy of selling rupee debt after the Brexit and they have sold equity in moderate amounts. The domestic institutions have been shoring up the market. The breadth has been good with retail strongly bullish. The monsoon has, so far, boosted sentiment.

Technically speaking, the short-term pattern appears to be one of narrow range-bound trading. Presumably, the market is looking for triggers. Breakouts/breakdowns beyond 8,300, 7,970, would probably lead to a 200-300 point move in the direction of the move.

The creation of weekly Nifty Bank options opens up a possibility of calendar trades. For example, we could take a long July 28, 17,200p (164), long July 28, 18,200c (188) position. This is zero-delta (equidistant from spot) with spot at 17,690. It costs 352, with breakevens at roughly 16,850, 18,550. Either end could be struck on two big trending sessions. The trader can also sell the July 7, 17,200p (39) and July 7, 18,200c (32). That short strangle brings in 71, reducing cost of the long strangle, if the short position expires without being hit. If the short strangle is hit, the long strangle will also gain in value, so this is not too risky.

In the July Nifty call chain, there's good open interest (OI) till 9,000 but the peak OI is at 8,500c. In the July Nifty put chain, there's good OI till 7,000p, with a big peak at 7,500p and another big peak at 8,000p. Put-call ratios (PCRs) are not very reliable close to expiry but the July PCR is at 0.99 which is neutral.

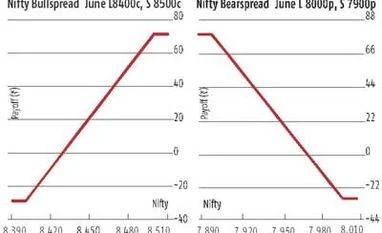

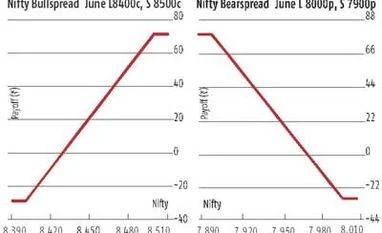

A bullspread with long July 8,400c (67), short 8,500c (39) costs 28 and pays a maximum 72. It is about 200 points from money. A bearspread with long 8,000p (61), short 7,900p (42) costs 19 and pays a maximum 81. This is about 200 points from money. The asymmetry in risk:return ratios for these two spreads reflects bullish expectations. The premiums also seem under-priced for both puts and calls. The implied volatility is low, given a month and the number of likely news-events before settlement (July 28).

These positions are zero-delta if combined. The resulting long-short strangle set costs 47 and pays 53 at maximum. There is a reasonable chance that one of these will be hit in the next four weeks.

)

)