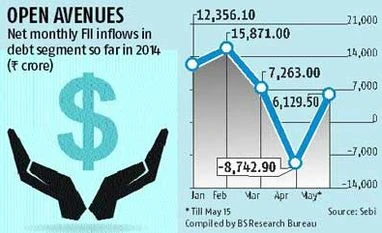

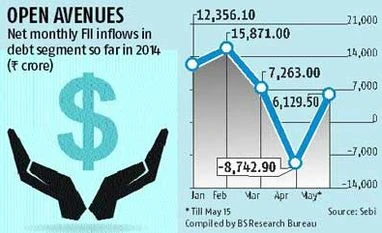

FII flows in debt seen picking up on stable govt

Inflows of Rs 6,000 crore in the first fortnight of this month

Neelasri Barman Mumbai Foreign institutional investors (FIIs) are set to pump in more funds in debt securities, as the next government under the Bharatiya Janata Party (BJP) is expected to be a stable one and is seen as growth-oriented by market participants.

The flow of FII money in debt instruments picked up this month - they were net-sellers in April - as hopes for a stable government became firm, particularly after exit polls showed BJP coming close to a simple majority in the Lok Sabha. The final result on Friday showed BJP bagged 282 seats on its own - 10 more than the majority mark in the 543-member House - while the National Democratic Alliance, which the party leads, won 334.

The Securities and Exchange Board of India (Sebi) data show FIIs had turned net-sellers in April - after being net-buyers for four months in a row - as they were not permitted to invest in short-term securities like treasury bills. But the trend reversed this month, with FIIs net-buying debt securities to the tune of Rs 6,130 crore till May 15.

"There will be more foreign inflows, both in equity and debt, with the formation of a stable government and reforms being pushed. The $30-billion FII limit in government securities has not been exhausted yet, so the flows will continue. There also are high interest rate differentials between US treasuries and Indian bonds which will help attract flows to India," said N S Venkatesh, executive director & head of treasury, IDBI Bank.

At present, the yield on the 10-year US treasury bills is 2.52 per cent, while that on the Indian 10-year benchmark closed at 8.83 per cent on Friday.

However, experts said the flows in debt might be limited to bonds of shorter tenures for now, as the FIIs were waiting for the Union Budget, likely in early July. It is very difficult to completely hedge long-term bonds, so investing in long-term instruments depends on currency and interest rates. "Some clarity is needed on fiscal deficit, inflation, etc. The outlook on the rupee is surely better than earlier. Funds will flow in a big way after the Budget. Currently, FIIs are buying short-term government and corporate bonds. Flows could pick up in June or July after the Budget. By then, there will also be greater clarity on monsoon," said a senior official of a primary dealer.

On April 1, the Reserve Bank of India had said in its first bi-monthly monetary policy, to encourage longer-term flows and reduce volatility, FII investments in government securities would be permitted only in dated ones with maturity of a year or more; the existing investment in treasury bills would be allowed to taper off on maturity or sale.

)

)