FT sees reverse arbitrage trades

The trading strategy is aimed at making a quick buck from the price anomaly between Financial Technologies shares and stock futures

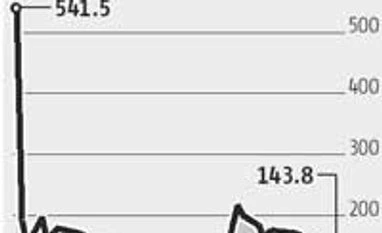

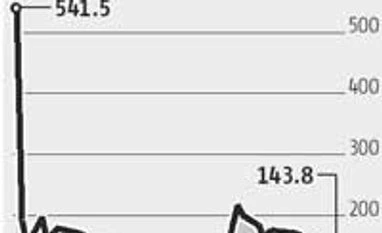

Sneha Padiyath Mumbai Affluent traders are initiating trades involving shares and stock futures of Financial Technologies (FT) before the ban on its equity derivatives contracts takes affect by the month-end. The trading strategy-known as reverse arbitrage - is aimed at making a quick buck from the price anomaly between FT shares and stock futures.

In reverse arbitrage, traders buy the stock futures and sell the underlying shares simultaneously when shares fall below the value of stock futures. In the case of the FT, the stock was trading at Rs 145, while stock futures were at Rs 140. Traders have initiated the trade to earn Rs 5.

"Whenever there is huge volatility in a stock or some management-related event in the company, traders get opportunities for reverse arbitrage. Considering the events that have impacted FT in the last two months, traders are finding good reverse arbitrage opportunities in the stock price," said Ashish Chaturmohta, head-technical and derivatives analysts at Fortune Equity Brokers.

The Jignesh-Shah promoted FT, which is the parent company of National Stock Exchange Ltd (NSEL) mired in controversies since August this year for non-payment of dues, has been volatile on the bourses since them. FT shares have dropped about 74 per cent since then.

On Monday, FT was banned from the NSE's equity derivatives segment. The exchange said that FT's existing contracts for the next three series until December would expire on October 31, 2013 and that no further contracts will be issued from November onwards.

On Tuesday, the stock was up 1.9 per cent to Rs 143.80.

Technical analysts said the uptake in the share price was therefore due to short-covering. A large portion of the positions held in the stock were mainly short positions which were built as the stock prices began to decline.

"Most of the positions built in the stock have been short positions. Since the F&O series would cease to exist on October 31, traders are looking to square off positions, which has led to an uptake in the stock," said Siddharth Bhamre, head of derivatives, Angel Broking.

Analysts said the company's exclusion from the F&O segment was not a surprise.

"It is not a surprise that the company has been banned from the F&O segment. Normally, a company is allowed to complete the three-month series before being excluded. But in this case, the regulator and the exchange have taken the decision bearing in mind the uncertainty surrounding the company. Same was done with Satyam Futures which were removed with less than one month notice," said Yogesh Radke, Head of Quantitative Research at Edelweiss Securities.

Analysts said FT shares were largely driven by speculative activity and that no 'serious players' were invested in it.

"Traders participating in this stock currently are largely the non-institutional segment as major Institutional investors exited the stock when the NSEL problem began, about two months back. It is mainly driven by HNIs or retail investors who are holders of shares in the company," said Radke

Analysts said that the delivery volumes for the stock on the exchanges had come off to around nine per cent.

)

)