FUND PICK: Mirae Asset Emerging Bluechip Fund

A consistent outperformer

CRISIL ResearchMirae Asset Emerging Bluechip Fund has topped the lists of funds on CRISIL Fund Rank for the December quarter. It has been ranked in the top 30 percentile (CRISIL Fund Rank 1 or 2) for past four quarters, under the small- and mid-cap equity category.

The fund aspires to generate income and capital appreciation from a diversified portfolio predominantly investing in Indian equities and equity- related securities of firms, which are not part of the top 100 stocks by market capitalisation (m-cap) but with a m-cap of at least Rs 100 crore at the time of investment. The fund is managed by Neelesh Surana and had quarterly average AUM of Rs 1,054 crore at the end of the December quarter.

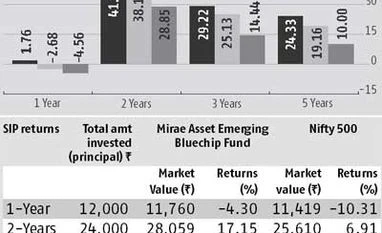

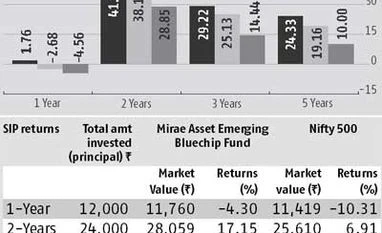

Superior performance The fund has constantly outperformed its benchmark (Nifty Midcap 100) and category (represented by the Small and Mid-Cap Funds under CRISIL Mutual Fund Ranking), across various time frames (see chart). Over the past one year when the economy was weathering a downturn, the fund still delivered positive returns, whereas the benchmark and the category posted negative returns.

Since its inception on July 9, 2010, the fund always outpaced its benchmark and the category through all market cycles.

An investment of Rs 1,000 at inception would have appreciated to Rs 2,977 (compounded annualised return of 21.6 per cent), as on February 1, 2016. A similar investment in the category and benchmark would have grown to Rs 2,332 (16.4 per cent) and Rs 1,509 (7.7 per cent), respectively. Likewise, a monthly systematic investment plan (SIP) of Rs 1,000, over three years, would grow to Rs 55,058 (on a principal of Rs 36,000) delivering an annualised return of 31.3 per cent vis-à-vis the benchmark’s 17.11 per cent (Rs 45,763).

Portfolio analysis Over past three years, the fund, on an average held 59 stocks, with the top five stocks accounting for 19 per cent of the total equity holdings, indicating a well-diversified portfolio. It has held 20 stocks consistently in the past three years, of which Britannia emerged to be the best outlay, delivering 81.2 per cent annualised returns, followed by Amara Raja Batteries (53.6 per cent), Vinati Organics (43.2 per cent), Hindustan Petroleum (42.2 per cent) and Gateway Distriparks (32.1 per cent).

Over the past three years, top five sectors, on an average, formed 56 per cent of the equity portfolio. The fund had the highest exposure to banking at an average 14.8 per cent, followed by pharmaceuticals (12.45 per cent) and consumer non-durables (8.45 per cent).

)

)