Fund-raising through QIPs hits 19-month low

One firm mobilises money via route in this quarter, compared to 12 a year ago

Deepak KorgaonkarPuneet Wadhwa Mumbai/ New Delhi The fall of markets from their peak levels earlier this year, and the range-bound movement since then, has not only dampened investor sentiment, but has also kept companies at bay from raising funds via the qualified institutional placement (QIP) route over the past few months, which hit a 19-month low in November.

(QIP is a process to enable listed companies to raise finance through the issue of securities to qualified institutional buyers.)

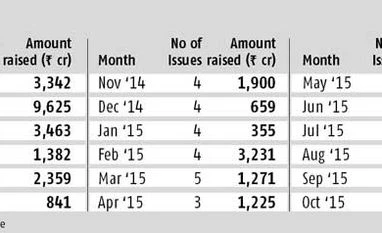

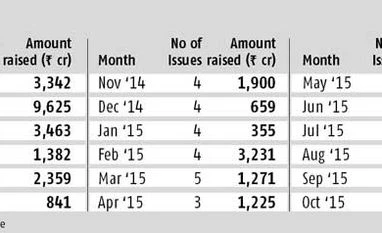

So far in the current quarter (October to December), only J Kumar Infraprojects raised Rs 409 crore through the QIP route, compared to 12 companies that had mobilised Rs 3,400 crore in the corresponding period last year. Not a single company has raised funds via the QIP route so far in November. During February-April 2014, no company had used the QIP route.

So far in 2015, 28 firms raised Rs 17,694 crore through QIP, which is 44 per cent lower compared to the corresponding period in 2014, when 29 companies had mobilised Rs 31,025 crore. As many as 33 firms had raised Rs 31,684 crore in the whole of 2014.

Analysts attribute this to volatile market conditions that have kept companies from raising funds through this route.

“Market conditions have turned for the worse in the past couple of months and many companies are not urgently looking to raise cash at lower valuations. That apart, many QIPs, over the past few years, have been by debt-laden companies looking to reduce their debt. While these were done at reasonable valuations, investors subscribed in the hope of an economic recovery-led improvement in numbers for these companies, but have been let down so far. So, the appetite for funding such companies has been lower,” said Aashish Somaiyaa, managing director and chief executive, Motilal Oswal AMC.

Negative returns In the past one-and-a-half months, the S&P BSE Sensex has corrected one per cent and slipped 12 per cent from its peak in March. As a result, most QIPs in 2015 have returned negative value, with 16 out of 28 trading below their offer price.

“The secondary markets have lost considerable ground since their peak in March. That apart, a lot of investors have lost money in QIPs. These are the two main reasons why QIPs have failed to pick up this year. The road ahead depends on how the secondary markets play out. We need at least a 10 to 15 per cent rally from here for companies and investors to get attracted to QIPs,” said G Chokkalingam, founder and managing director of Equinomics Research & Advisory.

“A pick-up can happen in case any particular theme has a dream run, as was the case with the logistics sector a few months ago. So, either there is a broad-based rally that takes the markets higher, or there is a theme that does well, which will re-kindle appetite for fund-raising via the QIP route,” Chokkalingam adds.

Meanwhile, big-ticket Initial Public Offerings (IPOs) of shares of InterGlobe Aviation, Coffee Day Enterprises, and S H Kelar & Company, in October saw listed companies postpone their fund-raising plans, analysts say.

These three companies had collectively raised Rs 4,675 crore, the highest since December 2012, when three firms mobilised Rs 5,314 crore from the primary market, according to data from Prime Database.

)

)