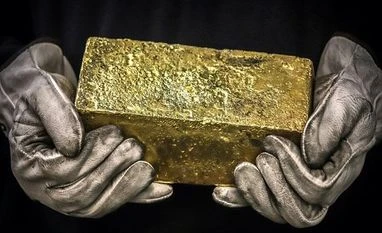

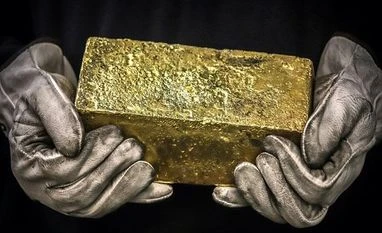

Gold prices dip as investor focus turns to Fed tapering, inflation comments

Spot gold XAU= ease 0.4% to $1,780.30 per ounce by 0750 GMT. U.S. gold futures GCv1 fell 0.4% to $1,781.80.

)

Explore Business Standard

Spot gold XAU= ease 0.4% to $1,780.30 per ounce by 0750 GMT. U.S. gold futures GCv1 fell 0.4% to $1,781.80.

)

Gold prices eased on Wednesday as traders cautiously awaited the outcome of the U.S. Federal Reserve policy meeting where the central bank is likely to announce tapering of its economic support and could address growing inflationary risks.

Spot gold XAU= ease 0.4% to $1,780.30 per ounce by 0750 GMT. U.S. gold futures GCv1 fell 0.4% to $1,781.80.

The Fed policy announcement is due at 1400 GMT. The central bank is likely to begin paring its monthly asset purchases by $15 billion each month until ending them by mid-2022.

Investors will also look out for any clues as to when the U.S. central bank might raise interest rates to contain growing inflationary pressure.

"In the short-term, gold could remain under pressure because a lot of central banks will be tilted toward normalising monetary policy, gradually tapering their asset purchases, especially given higher inflation," Hitesh Jain, lead analyst at Mumbai-based Yes Securities, said.

Reduced stimulus and interest rate hikes tend to push government bond yields up, raising the opportunity cost of holding non-yielding bullion.

"But, if bond markets are right in their expectations for higher inflation and lower growth - stagflation, in the years ahead, that should be quite bullish for gold," Jain said, noting that subdued longer-term U.S. bond yields reflected concerns of stagflation.

Market participants are also eyeing a Bank of England policy meeting on Thursday after data suggested unemployment is unlikely to rise sharply, bolstering the case for a rate hike.

On the technical front, "a decline below $1,750 in gold would show a new bearish impulse, while a surpass of $1,800 can open space for new recoveries to the next resistance placed at $1,820-1,830," Carlo Alberto De Casa, external analyst at Kinesis Money, said in a note.

Spot silver XAG= fell 0.3% to $23.45 per ounce. Platinum XPT= dropped 0.1% to $1,037.48, while palladium XPD= rose 0.3% to $2,016.97.

(Reporting by Nakul Iyer in Bengaluru; Editing by Ramakrishnan M, Sherry Jacob-Phillips and Subhranshu Sahu)

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

First Published: Nov 03 2021 | 2:52 PM IST