Highway contracts: Hybrid annuity projects to gain pace

While some large players are cautious, experts say this model cannot be ignored for long, given NHAI's strong pipeline

Hamsini Karthik Mumbai Introduced last year by the Union ministry of road transport and highways, acceptance of the hybrid annuity model or HAM for tendering of road projects by the National Highways Authority of India (NHAI) was initially weak. It continues to remain so.

For instance, the first bid under the HAM model, for four-laning of the Solan-Kaithalighat section in Himachal Pradesh, had no takers. The bid terms had to be revised.

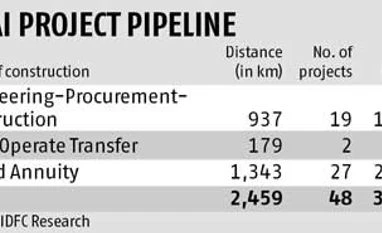

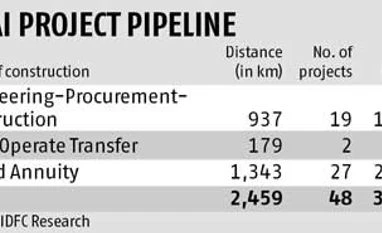

Till date, five projects totalling 279 km (Rs 6,700 crore in value) have been awarded. The FY16 target for HAM was set at 1,400 km. Experts, however, say with more than half of NHAI’s project pipeline lined up under HAM and the government having addressed the sector's key concerns, this is likely to pick up.

After the first bid failed, the government addressed some of the key impediments, particularly on forest clearance and land acquisition. Further, HAM, often referred to as a mix of the Build, Operate, Transfer (BOT) and Engineering, Procurement, Construction (EPC) models, addresses the concerns on both.

Under the latter model, a winning contractor builds the road project and hands it over to the government after completing the construction. Under BOT, he builds the project and operates (collects toll, maintains the road) it, handing it over on completion of the concession period.

Primary concerns such as land acquisition, traffic risk and inflation in BOT projects have been adequately addressed in HAM. Further, with NHAI pitching in 40 per cent of the capital, the project equity risk is likely to be lowered to 18 per cent (as against 30 per cent for BOT) of the project cost, resulting in a superior return profile to that under BOT.

HAM scores over EPC for the government as well. From 100 per cent cost of capital to be borne by NHAI under EPC, the exposure is reduced to 40 per cent under HAM.

The question is whether companies would opt for HAM in its new avatar. Virendra Mhaiskar, chairman, IRB Infrastructure, terming HAM a deferred EPC payment structure, feels it might not offer good operating margins or a return creation opportunity vis-a-vis the current BOT model that his company prefers. “Just to wet our feet and find out how really the process happens, we (IRB) might participate in a few bids under HAM but for now, we are not looking at it in a big way,” he said.

Experts say the approach on HAM will depend on a company's stance and current needs. It would have little to do with any concern over the project or model.

Santosh Yellapu of Angel Broking says, “How companies want to build their order books would determine if they want to bid for HAM projects.” According to him, larger companies such as IRB Infra, Ashoka Buildcon and IL&FS Transportation Networks might not participate in the current round of HAM bids, as their current order book is comfortable. Smaller companies such as MBL Infrastructures, MEP Infrastructure Developers and Welspun Corporation, whose order book is in the process of being strengthened, might have more appetite.

A report by ratings agency ICRA adds that features of the HAM model are expected to elicit a favourable response, especially from large EPC players and some BOT ones. Even so, despite a large part of the concerns being addressed, there are other issues influencing companies. Analysts at Emkay Financial Services point to the large difference between L1 (lowest bid price) and L2 (second lowest price) as signifying that no developer wants to bid aggressively.

Some are more optimistic. Kunal Seth of Prabhudas Lilladher feels the larger entities might be warming up to the idea. Also, with BOT projects unlikely to see any meaningful return for older entities such as Gammon, GMR Infra and HCC, given the strain on their finances, some experts feel the trend of declining bids under the BOT model could go on. As more bids open under the HAM model, it might compel the larger ones to change their operating strategy.

For example, the pipeline for EPC projects, though higher than BOT, is less than half that for HAM. “Instead of bidding for three-four small road projects, a large HAM project might be more rewarding for the bigger players as well,” says Seth.

)

)