India's vegetable oil import to set new record at 12 mt this year

India might import larger tonnages of crude palm oil (CPO), which will bring domestic refiners back to business

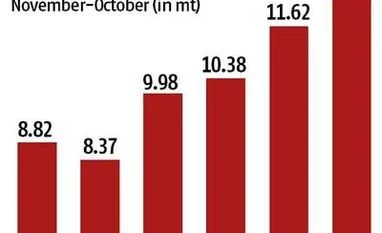

Dilip Kumar Jha Mumbai India’s vegetable oil import is likely to hit a new record this year at 12.3 million tonnes (mt) due to continuous rise in demand amid falling prices and lower output from domestic sources. At this level, however, vegetable oil import will rise six per cent from 11.62 mt in the previous year.

Delay in the monsoon, coupled with an overall deficit of showers this season, has resulted in the sharp decline in the oilseeds output this kharif harvesting season. The first advanced estimate of India’s oilseeds output at 19.66 mt, a sharp decline from 22.41 mt in the previous year and 21.83 per cent of the target. The decline in oilseeds production would lead to decline in the vegetable oil output, while the sharp upsurge in demand on falling prices is set to widen the deficit.

“Domestic crushing has got off to a slow start. As a result, India is likely to continue to suck in larger imports of palm, soya and sunflower oils. The country will store domestically produced oilseeds and will front-load oil imports. India’s consumption of vegetable oils will be strong on account of low prices and a feel good factor prevalent with the new government. Consequently, we forecast India’s veg oil import to create a new record at 12.3 million tonnes for the oil year 14-15,” said Dorab Mistry, director, Godrej International.

India might import larger tonnages of crude palm oil (CPO), which will bring domestic refiners back to business. Consumption of vegetable oils, however, will be strong on account of low prices and a feel good factor prevalent with the new government.

“At per capita consumption of 14.4 kg, total vegetable oil requirement stood at 18.28 mt in 2013-14 which is expected to rise to 19.30 mt in 2014-15 at an overall consumption growth rate of 5.6 per cent,” said B V Mehta, executive director, SEA. Rising import would translate into India’s growing dependence on overseas producers. At 12.3 mt of record import, India’s dependence on overseas suppliers would grow to 65 per cent of its annual vegetable oil consumption.

India imports CPO largely from Indonesia and Malaysia for blending with other vegetable oils produced from local oilseeds. Both countries cut export duty to nil to push their surplus quantity into India. Falling prices have been a major factor for import surge. For example, average RBD (refined, bleached and diodized) palmolein price fell sharply to $727 in October from $938 a tonne in March. Similarly, CPO price fell sharply to $704 a tonne from 951 a tonne, crude soybean oil to $838 a tonne from $1,000 a tonne and crude sunflower oil to $878 a tonne in October from $974 a tonne in March.

“The recent drop in prices has made life extremely difficult for India’s oilseed farmers. We must remember that Indian farmers are poor due to the small size of Indian farms and their low productivity. Current oilseed prices in India make oilseed planting uneconomic. Therefore, the industry in India is urging the new dynamic government, to come to the rescue of the beleaguered oilseed farmers. An import duty of 10 per cent on all crude oils and 25 per cent on all refined oils has been suggested. If such steps are not taken, there will be extreme distress among Indian oilseed farmers when they bring their harvested crop to market,” Mistry said.

Increasing import of refined oil has idled a majority of installed capacity of Indian refinery. During the oil year 12-13, refined oil import contributed to over 21 per cent of total import of 10.38 million tonnes. In 2013-14, however, the share of refined oil diminished to 13.5 per cent of the overall vegetable oil import of 11.62 mt.

)

)