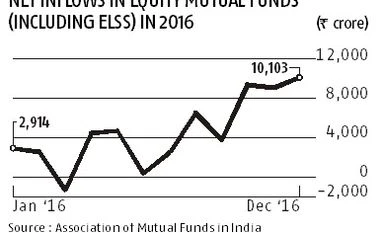

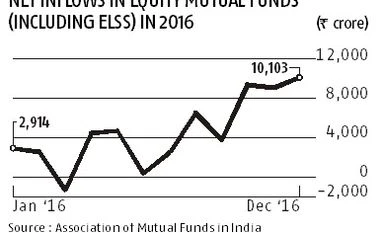

Strong inflows in equity mutual fund schemes despite volatility in December have helped the sector end 2016 on a positive note. A total of over Rs 10,000 crore on a net basis made its way into the equity segment in December, the highest since June 2015.

The number of equity accounts surpassed the 39-million mark, while the overall investors’ base crossed 50 million.

Increasingly mature investors are staying put during volatile times and using such opportunities to invest more. Over four million equity accounts were added during 2016.

Sundeep Sikka, chief executive officer (CEO) of Reliance Mutual Fund, says, "The monthly systematic investment plan (SIP) book is increasing and money has continued to flow from smaller centres as well. What is worth noticing is the fact that corrections in the market were used as buying opportunities by investors, which is a sign of growing awareness about mutual funds."

The overall number of SIP accounts is well over 10 million and the average monthly SIP inflow is ruling at over Rs 3,500 crore. This essentially means that mutual funds have a consistent and sticky inflow of over Rs 40,000 crore from domestic investors per year. This is good enough to counter any outgo triggered by foreign investors.

Anjaneya Gautam, national head (mutual funds) at Bajaj Capital, says, “The understanding about asset allocation has seen a fair improvement among Indian investors over the last few years. Investors have started making additional purchases whenever the market sees a correction. On top of it, there is a sizeable cushion of inflows through the SIP route.”

In December, the assets under management of equity schemes, including ELSS, stood at Rs 4.69 lakh crore against Rs 4.05 lakh crore a year ago.

The balanced funds category continued to see strong inflows at Rs 3,947 crore in December. However, income funds witnessed an outflow of Rs 33,182 crore while gilt funds had an outflow of Rs 1,190 crore. On an overall basis, the net inflow,including all fund categories, in December was Rs 10,923 crore.

The total assets under management on December 31 were Rs 16.46 lakh crore. Income funds had the largest chunk of Rs 7.48 lakh crore followed by diversified equity funds at Rs 4.19 lakh crore and liquid debt funds at Rs 3.08 lakh crore. Balanced funds, which are seeing considerable traction, had Rs 64,954 crore assets under management while assets of ELSS stood at Rs 50,113 crore.

)

)