Initial public offers turn scarce in the new year

Activity could pick up in the second half, says Prime Database

)

Explore Business Standard

Activity could pick up in the second half, says Prime Database

)

The lull in the Initial Public Offering (IPO) market can continue for some more time with few companies applying to the regulator for approvals.

According to primary market tracking firm Prime Database, only four companies, intending to raise a cumulative Rs 2,700 crore, are awaiting the approval of the capital market regulator, Securities and Exchange Board of India (Sebi).

About a dozen companies, which can raise a total of nearly Rs 2,800 crore, are not entering the market despite having regulatory approvals.

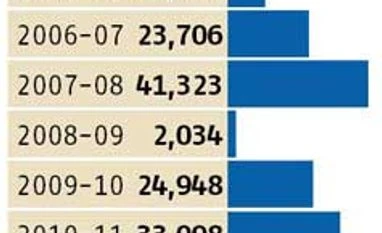

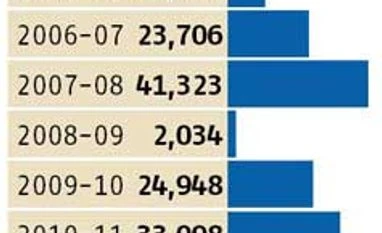

The year 2013-14 saw fund mobilisation of only Rs 1,205 crore through IPOs.

Interestingly, the year saw only one main board IPO, of Just Dial, during the entire year. A couple of issues failed to go through.

“The market has not been IPO-friendly for three years, due to a variety of factors. This includes overall poor sentiment, secondary market volatility, promoters not getting the valuations they think they deserve, apprehensions on regulator’s views on valuations and the lack of appetite for equity of big-time issuers from the infrastructure sector, especially power, telecom and real estate,” said Pranav Haldea, managing director, Prime Database.

Most activity during 2013-14 was seen on the small and medium enterprises (SME) platform, which saw over three dozen IPOs, which collected a total of Rs 286 crore.

Haldea said there could be a revival in the IPO market in the second half of this financial year.

“There is a lot of pent-up demand as far as issuers are concerned, with numerous companies in dire need of equity infusion. There are also scores of companies where private equity firms or other institutional investors are desperately looking for an exit,” he said.

The best year for the IPO market in terms of capital mobilisation was 2007-08, when companies had raised Rs 41,323 crore.

According to Prime, a strong government post-elections can act as a catalyst for revival in investor sentiment.

“The secondary markets are already extremely buoyant and the bull run is expected to continue, a pre-requisite for revival of the primary markets. Moreover, globally too, the IPO markets have been very active for several months and global investors will have an appetite for Indian IPOs too,” said Prime.

First Published: Apr 01 2014 | 10:44 PM IST