Markets cheer new tax residency certificate rules

BS Reporter Mumbai The finance minister's move to dilute the tax residency certificate (TRC) requirements for foreign institutional investors (FIIs) has been welcomed by the markets with Indian shares closing at their highest in about one-and-a-half months today in a late rally.

The gains also tracked advances in European share markets as some investors positioned for the European Central Bank and the US Federal Reserve to extend their monetary measures to stimulate economic growth.

The Reserve Bank of India's (RBI) policy review and its stance on future rate cuts, especially after the recent slump in commodity prices, are important for the near-term direction of the market, with many analysts saying a cut of 25 basis points (bps) seems already discounted at current valuations.

Citigroup said in a report that some investors in Europe referred to India as a 'tease' market, which is on the radar once again due to lower commodity prices, expansionary global monetary conditions and prospects of a good monsoon. "RBI decision and direction, headroom of future rate cuts are all important now," said Aneesh Srivastava, chief investment officer at IDBI Federal Life Insurance. A 25 bps cut is mostly discounted after the recent rally, Srivastava added.

After a firm opening on Tuesday, key indices fell mid-way through the session as political uncertainty heightened with the Supreme Court seeking a report on the alleged political interference in an ongoing probe into coal block allocations.

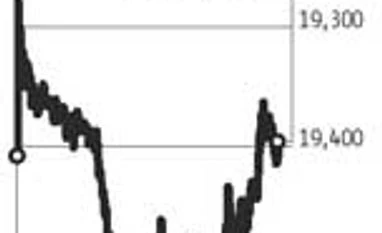

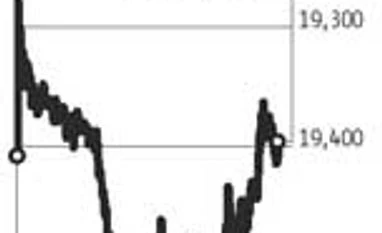

The benchmark BSE index rose 0.6 per cent, or 116.68 points, to end at 19,504.18, gaining for the first month in three months with a 3.5 per cent rise in April. The broader NSE index rose 0.44 per cent, or 26.10 points, to end at 5,930.20, closing above the psychologically important 5,900 level, gaining 4.4 per cent for April.

The markets will be closed on Wednesday for the May Day holiday.

Finance Minister P Chidambaram removed a clause which said TRCs were not sufficient for FIIs to obtain benefits under the double taxation avoidance agreements (DTAAs) that India has with various nations. The clarification that a tax residency certificate issued by a foreign government would be an accepted proof of residency for tax purposes also helped the stocks.

Hindustan Unilever Ltd shares rose 17.4 per cent to mark their all-time highest close after Anglo-Dutch consumer goods giant Unilever Plc offered to pay as much as $5.4 billion to raise its stake in its Indian unit. Other FMCG stocks also saw a rub-off of Unilever's open offer. Colgate-Palmolive India Ltd rose 5.8 per cent and ITC Ltd ended 1.3 per cent higher.

Shares in Dabur India Ltd rose 0.8 per cent after its January-March net profit rose about 17 per cent to Rs 201 crore. Sterlite Industries (India) Ltd rose 4.2 per cent after its January-March profit beat consensus estimates by a wide margin. Jet Airways shares gained two per cent a day after a founder group company of the carrier said it would sell a stake as part of public float rules.

)

)