Markets close in the red after 4 days of gains

Downward revision of GDP estimate for FY16 cancel the 'Fed cheer' gain

BS Reporter Mumbai Indian key stock indices failed to hold the US Fed cheer on Friday and ended a percentage point lower. The Union government's mid-year economic review, which revised the gross domestic product (GDP) growth estimate from the earlier 8-8.1 per cent to 7-7.5 per cent weakened the sentiment.

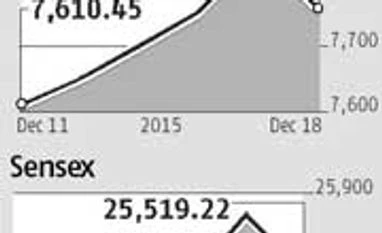

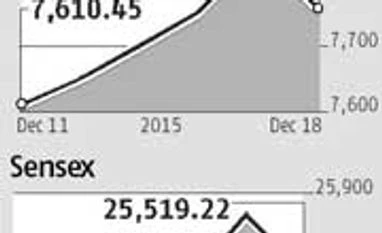

The BSE's benchmark 30-share Sensex lost 284 points to close at 25,519.22. The National Stock Exchange's Nifty 50 closed at 7,761, down 82 points. Stocks in information technology (IT), pharmaceuticals, banks and metals dragged down the indices. The market breadth was weak, as out of the 50 shares in the Nifty, 40 closed in the red.

“Investors seem to be worried with the government having lowered its GDP growth forecast for FY16. Further, continued weakness in commodity prices globally has raised concerns on global growth,” said Gaurav Jain, director, Hem Securities. Prior to Friday’s weak trading, Indian shares traded higher for the first four days of the week, with the market having factored in a US Federal Reserve decision to raise the policy rate by 25 basis points. The market optimism was due to possibility of certainty in cash flow after the Fed action. The Fed did raise the rate by the expected amount on Wednesday.

“The Fed hike has had little impact on markets globally, with the event largely discounted early on. The cautious outlook for FY17 by the (government’s) chief economic advisor on Friday likely impacted the sentiment,” said Dipen Shah, senior vice-president at Kotak Securities.

However, some in the market are maintaining the GDP revision was nothing new and the market was expecting it. “The change in the growth forecast by the government, on the back of the impact of agricultural output slowing due to a poor monsoon, is not a surprise. The forecast by Moody’s was 7.4 per cent. Likewise, the consensus estimate from Bloomberg was 7.4 per cent. Acceptance of the reality by the government has just come about and was already anticipated by most market analysts in their assumptions. At the margin, things are getting slightly better, as evidenced by the 9.8 per cent IIP (Index of Industrial Production) growth in October,” said Sandeep Nayak, executive director at Centrum Broking.

The sentiment got worsened on the back of the bill in the US legislature to impose a special fee of $4,000 on certain categories of H-1B visas and $4,500 on L-1 visas. IT stocks bore the brunt. Heavyweights Infosys and Tata Consultancy Services lost one to two per cent of their value in Friday's trade. The Nifty IT index was down 1.35 per cent. Among the sectoral indices, consumer durables and utilities were the top gainers, up one per cent and 0.3 per cent, respectively. On the NSE, the top gainers, Adani Ports and Idea, gained 1.8 per cent and 0.9 cent, respectively. The top losers were Vedanta and UltraTech Cement, down 3.2 per cent and 2.9 per cent, respectively.

Both domestic and foreign investors were net sellers. By the provisional figures, foreign portfolio investors sold a net Rs 7 crore of shares and domestic investors offloaded holdings of Rs 405 crore.

)

)