MFs continued buying even as indices slid in Feb's 2nd half

Fund managers pumped Rs 6,000 cr in shares in February half of which came in the last week of the month

BS Reporter Mumbai India's equity fund managers continued their buying spree of stocks in February, putting in nearly Rs 6,000 crore at a time when equity markets remained weak.

This happened despite a slowing of new inflows from domestic investors.

'Buy on dips' has been a strategy for fund managers over the past year. In February, when the Sensex was around 23,000 and the Nifty at 7,000, they kept to the strategy and turned net buyers of stocks for a 22nd straight month, despite a stumbling market.

In fact, fund managers made a tepid beginning at the start of the month, with three days of continuous selling. The investment phase remained poor in the first weeks and at one point, it appeared the investment might not even reach Rs 3,000 crore. It changed dramatically in the second half, in particular the last week of the month, just before the Union Budget presentation on Monday. There was a sudden jump in buying of stocks as the Nifty slipped below 7,000 and the Sensex below 23,000. They poured about Rs 2,000 crore into shares in five days.

Navneet Munot, chief investment officer (CIO) of SBI Mutual Fund, says, "As the markets touched 6,900, people took advantage of the opportunity and deployed cash. The trend of buying at lows might continue if the incremental inflows in equity schemes remain decent."

This intensified on the Budget day as fund managers stoked a massive Rs 1,000-plus crore in a single trading session while the market had one of the wildest swings. In all, Rs 3,000 crore came in the last week of February.

Rajiv Shastri, chief executive officer of Peerless MF, says: "When will we buy if not when markets are cracking so much? On some days, there were great opportunities to put money in stocks, which fund managers precisely did."

Since then, the the markets have seen a sharp rise over the past two trading sessions. The Sensex is nearly 1,300 points up and the Nifty added 300 points, the biggest rally in Indian shares over seven years.

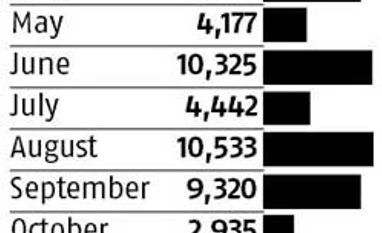

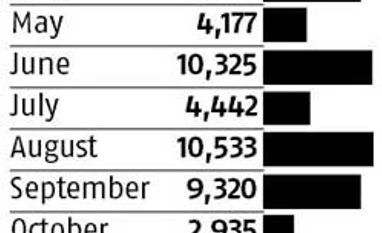

With the February buying, fund managers have bought Rs 76,300 crore of shares in the first 11 months of this financial year, the highest in the sector's history for any year. Currently, the total of assets managed in the equity segment is Rs 4 lakh crore.

)

)