MphasiS: Valuations capture possible HP stake sale

For the stock to justify current levels, it is necessary the company ramps up non-HP business and deliver consistent growth

Sheetal Agarwal Mumbai Mid-cap technology company MphasiS's scrip has surged about 30 per cent since April 30, against the eight per cent rise in the S&P BSE information technology (IT) index and a flattish S&P BSE Sensex. This run was fuelled by news MphasiS’s US-based parent, HP Inc, might sell its 61 per cent stake in the India subsidiary soon. While the news hasn't been confirmed, analysts believe the current valuations appear rich and factor in most positives, including a possible stake-sale.

“If we were to use the sale of Patni Computers to iGate (12 times the price/earnings ratio) in January 2011 as a point of reference, even if HP's stake-sale plays out, we see a downside of five per cent over the current market price. The current valuation of 12.9 times the FY14 estimated earnings restricts further upside," says Soumitra Chatterjee, IT analyst at Espirito Santo Securities.

Who would be interested in MphasiS and what does it offer a potential buyer? Analysts believe the top technology companies are unlikely to be interested in MphasiS, given they already have diversified presence across geographies and verticals. Many, however, believe mid-rung technology companies such as Tech Mahindra and L&T Infotech could team up with private equity funds to buy out HP's stake in MphasiS. While MphasiS has a mixed bag of offerings, there are challenges for potential buyers in the form of the growing non-HP business. Though HP's share has been declining, it still stand’s at about half the revenue.

MphasiS has strong presence in the Indian market, which could be an attractive diversification. However, its revenue growth from US and Europe regions has lagged a bit recently. Ankita Somani, IT analyst at Angel Broking, says, “MphasiS has good exposure in the India business, with deals such as Aadhaar and various government and non-government contracts. Companies such as Tech Mahindra, which have a higher exposure to Europe, might look at MphasiS to de-risk their business.” As of March-end, Asia-Pacific accounted for 16 per cent of MphasiS's revenues.

Most analysts believe HP (45 per cent of MphasiS's revenues) would have to give minimal revenue contracts to the potential buyer to make the deal possible; this would be aimed at ensuring revenue visibility. This is crucial, given HP has been struggling for the past few quarters. As a result, MphasiS's financial performance has been hit.

A positive aspect is MphasiS has managed to reduce HP’s share in revenues from about 70 per cent in FY10 to 45 per cent in the quarter ended March. “On the operational front, things are looking brighter for MphasiS than a year ago, with reducing client concentration and the direct channel growing faster,” says Chatterjee. However, for investor confidence to rise, the company would have to scale up non-HP exposure further.

The potential buyer would have to focus on growing the non-HP business to improve MphasiS's prospects. Whether HP sells out or not, consistent and sustainable growth in the non-HP business would be a game-changer for MphasiS. It would improve its financial performance, as well as the sentiment to the stock.

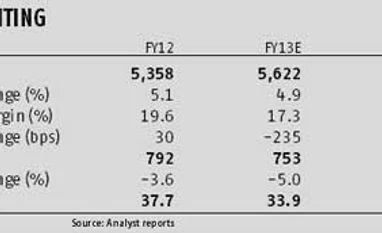

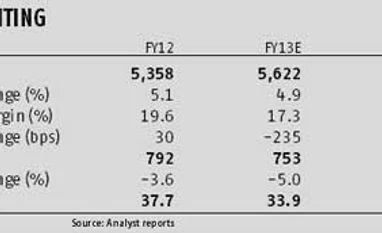

MphasiS’s cash generation is healthy and can be used for inorganic growth. The company is expected to generate free cash of about Rs 700 crore in FY13 (year ending October). Its cash kitty stood at Rs 412 crore in FY12. In November 2012, MphasiS acquired US-based Digital Risk, which provides risk, compliance and transaction management solutions in the US residential mortgage market. The acquisition boosted MphasiS’s revenue growth in the quarter ended March and contributed $34 million to revenues. However, at 10-11 per cent, Digital Risk's earnings before interest and tax margins are lower than those of MphasiS (15 per cent). Since Digital Risk accounts for 14-15 per cent of revenues, MphasiS's overall margins are likely to fall a bit.

)

)