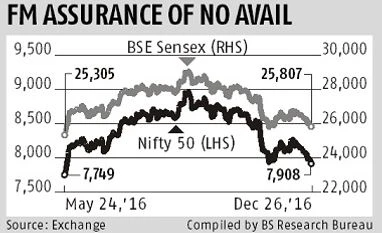

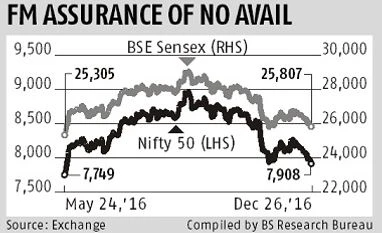

Nifty at 7-month low: Higher tax fears spook markets

FPIs pull out over Rs 1.1k cr

BS ReporterBloomberg Mumbai The benchmark Nifty on Monday dropped to its lowest level in seven months as foreign investors intensified their selling over concerns of higher taxes on share trading. The sell-off was triggered after Prime Minister Narendra Modi hinted at raising taxes in the capital markets.

“Low or zero tax rate is given to certain types of financial income. I call upon you to think about the contribution of market participants to the exchequer,” Modi said over the weekend, adding that the government is ready to take tough decisions in the interest of the nation.

Finance Minister Arun Jaitley’s clarification that the government doesn’t intend to levy tax on long-term capital gains failed to soothe investors’ nerves. The Nifty 50 index ended 77.5 points, or 0.97 per cent lower at 7,908, lowest since May 24. The Sensex ended at a one-month low of 25,807.1, down 233.6 points, or 0.9 per cent, erasing all the gains of 2016. The markets made two attempts at recovery; however, it failed to sustain the gains due to heavy selling, particularly from overseas investors.

Foreign portfolio investors (FPIs) on Monday sold shares worth nearly Rs 1,100 crore, data provided by stock exchanges showed. Domestic investors were net buyers to the tune of Rs 1,065 crore.

“Market fell as investors remain apprehensive on account of any announcement of higher capital gain tax in the upcoming budget. Post the demonetisation, the market is tending to find a new low due to negative underlying sentiment & lack of any triggers. Volumes are depressed since confidence level is low,” said Vinod Nair, head of research, Geojit BNP Paribas.

Overseas investors have taken off nearly $3 billion since November 8 following the government’s decision to ban high-denomination bank notes due to uncertainty over economic growth and corporate profits.

Benchmark indices have fallen for nine of the past 11 days, amid concerns a cash crunch caused by the government’s move to invalidate high-value bank notes will crimp economic growth. Monday’s trading volume on the NSE Nifty 50 Index was 40 per cent lower than the 30-day mean.

“Fears of excessive taxation by the government and the cash crunch is leading the market fall,” Chakri Lokapriya, the Mumbai-based managing director at TCG Advisory Services, which manages about $3 billion. Twenty five of the 30 members on the benchmark S&P BSE Sensex fell.

Among the Sensex components, the biggest losers were Cipla, which slipped 4.7 per cent and Lupin, which declined three per cent. State Bank of India retreated two per cent while Axis Bank lost 1.4 per cent in a seventh day of declines, the longest losing run since January 2014.

)

)