No end in sight to slump in sugar prices

Mills' rush to prepare for crushing season by raising more working capital adds to the downward pressure

Dilip Kumar Jha Mumbai The prolonged slump in sugar prices is worrying the industry, with no respite in sight. The national average wholesale price is Rs 29 a kg, a four-year low.

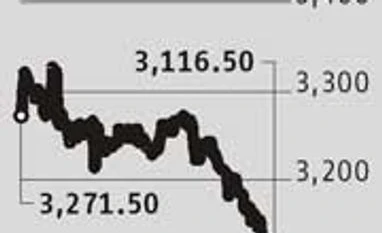

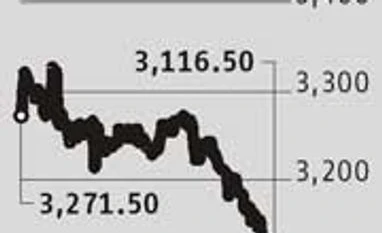

Data from the Bombay Sugar Merchants Association shows the average spot price of the benchmark M30 variety is Rs 3,116 a quintal, against the ex-factory price of Rs 2,830-2,870 a qtl. The commodity for delivery in December was quoted at Rs 2,852 a qtl on Wednesday after hitting Rs 2,847 a qtl, the lowest since June 13, 2012.

For quite a while, producers’ realisation has consistently been Rs 300– 400 a qtl lower than the average cost of production. Due to global oversupply, exports are also not an option for now. With estimates of a further decline in price, a number of mills fear they might run out of business and be declared sick.

“To raise working capital for commencing cane crushing this season, mills are in a hurry to liquidate stock. Since they have incurred losses through the year, due to lower realisation than the cost of production, they are under severe shortage in cash flow. Consequently, they are in a hurry to sell inventories,” said Abinash Verma, director general of the Indian Sugar Mills’ Association.

Trader sentiment is weak, with the community not building inventory for future sale. “When supply remains much higher than demand, prices are bound to go down. For the first time in 20 years, sugar prices have fallen during the festive days, presumed to be the demand season,” said Vivek Saraogi, managing director, Balrampur Chini.

The average cost of sugar production in Maharashtra is Rs 32 a kg, against the realisation of Rs 29 a kg. In Uttar Pradesh, average realisation is Rs 30 a kg against Rs 33 a kg as the cost of production. Mills in Karnataka and Tamil Nadu incur similar loss in output.

With 25.1 million tonnes of output during the 2012-13 season, the country has around seven mt of inventory as on date. The surplus is unlikely to recede unless export of at least three to four mt takes place in the first quarter of the crushing season (up to January 2014). Mills are set to add another five mt of monthly output after that. With around two mt of monthly consumption, the industry is likely to see a further addition to the surplus of at least three mt each month, beginning January.

As noted earlier, exports are not a feasible option at present. A handful of mills in Maharashtra have signed contracts for shipping around 300,000 tonnes of raw sugar, at an average of Rs 25.50-26 a kg. If there’s nothing more, prices are bound to fall further on this count alone, notes Verma.

According to Ajit Chougule, secretary, Maharashtra State Co-operative Sugar Factories Federation Ltd: “There were 108 functional co-operative sugar mills in 2012-13. This is likely to decline to less than 100 this year.”

Sanjay Tapriya, chief financial officer of Simbhaoli Sugars, believes the absence of bulk consumers has pulled down sugar prices. Amid expectation of a further price fall, bulk consumers have opted, for now, not to build any stock.

)

)