NSE files IPO papers with Sebi, looks to raise Rs 10,000 crore

Most major foreign shareholders opting for partial exit; LIC not divesting its 12.5%

Ashley Coutinho Mumbai The National Stock Exchange of India (NSE) filed its draft prospectus for a Rs 10,000-crore Initial Public Offer (IPO) of equity. It will be an Offer for Sale (OFS), of 111.4 million equity shares, 22.5% of the exchange’s post offer paid-up equity capital. At an expected valuation of Rs 40,000-45,000 crore, the issue size could be Rs 9,000-10,125 crore, the highest since the Coal India IPO of Rs 15,000 crore in 2010.

The exchange, which had been lobbying the regulator to self-list, will list on rival BSE.

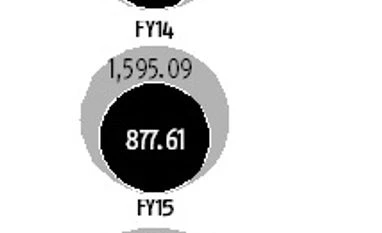

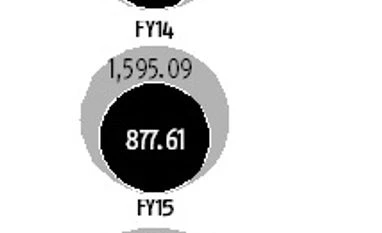

The OFS will give existing shareholders a chance to exit. Major shareholders are Life Insurance Corporation (LIC) with a 12.5% stake, and Gagil FDI, Aranda Investments and SAIF II SE Investments each holding five%. A few months earlier, Mauritius-based Veracity Investments had acquired a five% stake in the bourse from State Bank of India (SBI) for Rs 911 crore, valuing the exchange at Rs 18,200 crore.

Most shareholders have opted for a partial exit. The top selling foreign ones are Aranda, SAIF Investments, GAGIL FDI, Norwest Venture Partners, Citigroup Strategic Holdings and GS Strategic Investments. Major domestic shareholders doing so are SBI, SBI Capital, IFCI, Bajaj Holdings and Bank of Baroda. Tiger Global Five Holdings, which has three% stake, is offering all its shares. LIC is not parting with any.

The IPO is not likely to benefit employees directly, as the company does not run an Employees Stock Option Plan scheme.

NSE's board of directors had on June 23 given a nod to list the exchange in India and abroad. It had said the draft prospectus would be filed by January 2017 for domestic listing and another by April for doing so abroad.

Earlier this month, the bourse’s managing director (MD) and chief executive, Chitra Ramkrishna, had resigned, citing personal reasons. Her tenure was to end in March 2018. The board has set up a selection committee to find a replacement, with group president J Ravichandran as interim chief.

NSE has appointed Citigroup Global Markets, JM Financial Institutional Securities, Kotak Mahindra Capital and Morgan Stanley India as joint global coordinators to manage its IPO. Cyril Amarchand Mangaldas will be legal advisor. HDFC Bank, ICICI Securities, IDFC Bank and IIFL Holdings are the lead managers.

BSE, its rival and Asia's oldest bourse, has already filed a draft prospectus with the markets regulator for an Rs 1,200-crore IPO. It has also opted for the OFS route.

NSE is ranked first among exchanges globally in terms of stock index options and currency options trading volumes in 2015, according to the World Federation of Exchanges. By way of total turnover, NSE had a market share of 85% in equity cash trading, 94% in equity derivatives and 59% in currency derivatives for 2015-16, according to the Oliver Wyman Report.

)

)