Oil steadies as bullish IEA balances Chinese yuan slide

Reuters London Oil prices rose on Wednesday after an upbeat report from the International Energy Agency (IEA) outweighed the bearish impact of a further weakening of China's yuan currency and disappointing Chinese industrial output data.

The yuan hit a four-year low on Wednesday after China allowed it to slide further following a mini-devaluation on Tuesday to support the slowing Chinese economy, where industrial output grew less than expected in July.

China is the world's biggest oil consumer after the United States and a weaker yuan erodes Chinese purchasing power for dollar-denominated imports like oil, potentially reducing fuel demand.

But, while slowing demand from China has helped bring down oil prices at a time of oversupply by big producers in the Middle East, oil demand elsewhere is accelerating, the International Energy Agency (IEA) said on Wednesday.

The world oil market had begun to rebalance as low fuel prices stimulated extra consumption, it said.

"While a rebalancing has clearly begun, the process is likely to be prolonged as a supply overhang is expected to persist through 2016, suggesting global inventories will pile up further," the Paris-based energy watchdog said.

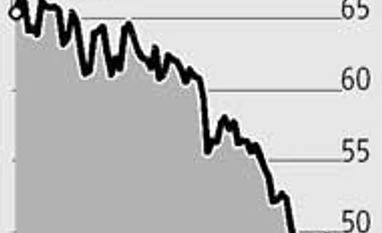

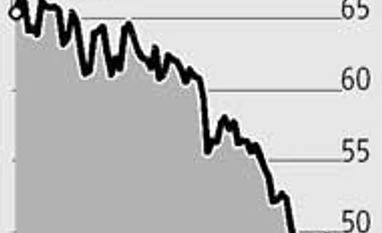

Benchmark Brent crude oil was up 30 cents a barrel at $49.48 by 1200 GMT, well above a six-month intraday low of $48.24 hit on Monday, but less than half its value a year ago.

US light crude oil was up 20 cents at $43.28. On Tuesday the US crude futures contract closed at its lowest settlement since March 2009.

World oil production is running at up to 3 million barrels per day (bpd) above consumption, analysts say, increasing stockpiles in all continents and depressing spot markets for crude and oil products such as gasoline and jet fuel.

But sharp price falls are beginning to encourage demand. The IEA forecast world oil demand would grow by 1.6 million bpd this year, up 200,000 bpd from its previous estimate and "the fastest pace in five years".

In the short term, the oil market is still worrying about the state of the Chinese economy, the largest consumer of most commodities, including many forms of energy such as coal. China's struggles also hit coal on Wednesday with benchmark futures falling to levels last seen a decade ago.

)

)