Rise in gold prices beats rally in most global mkts

The yellow metal has risen 9.2% so far this year

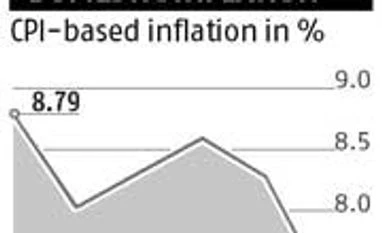

Puneet Wadhwa New Delhi If you thought investing in equities and riskier asset classes was the ‘in thing’, think again! The rise in gold prices in the first half of this year has been far higher than most equity markets, except India. The returns have also been higher than Consumer Price Index-based inflation in India, which ranged between 8.79 per cent and 7.31 per cent during this period.

“So far this year, gold is up 9.2 per cent. This surprised many market participants, as most analysts had predicted lower prices. Some investors took advantage of last year’s price correction to buy gold, but investment demand has remained tepid,” the World Gold Council (WGC) said in its recent investment commentary note for the first half of this year.

“So far, so good: Prices are up, volatility is down, and gold has defied the bearish outlook that many gold analysts trumpeted at the beginning of 2014. Early indicators suggest consumer demand remains resilient, even after a record year in 2013. Central bank net purchases have picked up, adding about 180 tonnes to official reserves from January to May 1. At the same time, jewellery demand had its best first quarter since 2005,” the note added.

By comparison, most global markets have gained less, except the Indian benchmarks — BSE Sensex and National Stock Exchange Nifty —, which rose about 20 per cent each during this period.

According to WGC, only a few assets saw a stronger performance: selected commodities (such as grains, nickel and palladium); Indian stocks (benefiting from the Bharatiya Janata Party’s sweep in the elections); and US real estate investment trusts.

Analysts also attribute the rise in gold to the geopolitical situation in West Asia, which created a flutter in riskier assets such as equities. “The geopolitical situation in Iraq and Syria created a panic-like situation in the world oil and equity markets. Second, apart from US and India, equity markets have not performed spectacularly well. So, people opted to invest in gold, given the low price and low volatility. Gold proved to be a bargain investment and a hedge in uncertain times. More, prices had seen a huge correction earlier and were in a bearish mode. This also attracted investors to the yellow metal,” says C P Krishnan, whole-time director, Geojit Comtrade.

Investment strategy WGC believes investors could benefit by adding gold as a hedge in their portfolios, irrespective of whether they see this as a tactical response to the current market environment or part of a comprehensive strategy on long-term risk management.

The WGC note says, “Gold also helps reduce long-term portfolio volatility by acting as a diversifier and can help increase risk-adjusted returns. Some investors may see the current low volatility environment as an opportunity to add gold; we consider that, in addition, gold should be seen as a strategic portfolio component.”

Krishnan of Geojit expects gold prices to remain range-bound. In case of a sudden spurt in prices, he expects investors to cash out. “I don’t think we will see a lot of volatility in the prices of riskier assets unless concern on the geopolitical front resurfaces. In case of India, a lot depends on the monsoon and government policies, too. If we have a good monsoon, prices could pick up by October, as purchasing capacity will rise. Since the chances of a good monsoon and easing government policies are less, I don’t expect a significant rise in the prices of gold. At best, these will remain range-bound,” he says.

)

)