Rising US yields could spoil party

Yield on 10-year US treasury is up 34 bps since July, pushing up the risk-reward for foreign investors in emerging equities

Krishna Kant Mumbai The risk-reward ratio is turning against emerging market stocks including those of India. The 10-year bond yield in the US is inching up after falling consistently for nearly three years. This, analysts say, may put pressure on risky assets such as emerging market equities including those of India.

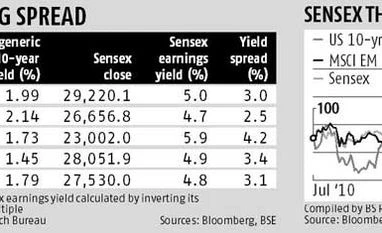

In the past three months, the yearly yield on the 10-year US government bond is up from 1.45 per cent at the end of July to 1.79 per cent now. The yields are at the highest level in the past five months but still down on a year-on-year basis. Bond yields were 2.14 per cent at the end of October 2015.

Bonds yields are calculated as a percentage of coupon payment to the bond price and higher yields mean bondholders (or investors) are asking for higher interest rate. Bond prices fall when interest rates rise and the opposite is true as well.

Analysts say this signals a potential rise in long-tenure interest rates, which could have a negative implication for risky assets such as emerging market equities. "As US government bonds are the default risk-free assets for global investors, a higher yield (or return) on US treasury bonds lessens the attractiveness of emerging market equities. This is especially true for risk-averse investors. This could translate into volatility on stock markets if not a downright sell-off by foreign investors," said Dhananjay Sinha, head, institutional equity, Emkay Global Financial Services.

Historically, there is a close correlation between the stock price movement in emerging markets and yields on US government bonds. For example, the current bull run in the Indian stock market started with the steady fall in the US bond yield from the highs of 2013.

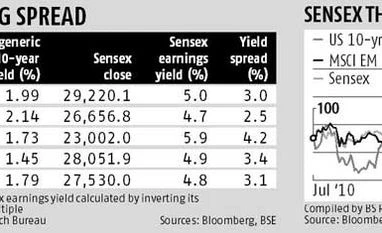

Bond yields in the US are down nearly 100 basis points from the 2013 high. During the same period, the benchmark BSE Sensex is up 48 per cent. Moreover, the chart shows the Sensex has moved in the opposite direction of US bonds yields during the period. One basis point in one-hundredth of a per cent.

The MSCI Emerging Market index shows a similar trend but the correlation is weaker due to the market rout in commodity-exporting countries such as Brazil, Russia, and South Africa. The fall in US bonds yields in the second half of 2013 and early 2014 was accompanied by a global meltdown in commodities and crude oil hitting corporate profits in key emerging markets. Things changed in 2016 and MSCI Emerging Market index made a 12-month high last month.

The bull run in emerging markets now faces risk of rising interest rates in the US. For example, the earnings yield for Sensex companies is down nearly 110 basis points from the high of 5.9 per cent at the end of February to 4.8 per cent now. (Earnings yield are the earnings per share for the most recent 12-month period divided by the current market price per share. It is the inverse of price-to-earnings ratio. Earnings yield is more of a return metric about how much an investment can earn back for investors, rather than a valuation metric about how much the investment is valued in the market by investors. Higher earnings yield means the stock is more attractive to investors.)

The excess earnings yield of Sensex over the US bond yield is down nearly 110 basis points during the period from three-year high of 4.2 per cent at the end of February 2016 to 3.1 per cent now. "A lower earnings yield spread for Sensex companies translates into lower risk-reward ratio for foreign investors, which raises the downside risk for markets," said Sinha.

Collectively, foreign institutional investors are the single-largest investors on Indian bourses, owning nearly 45 per cent of all floating or non-promoter shares in BSE 500 companies in terms of value.

Bulls, however, discount the impact of rising US bond yields on equity markets given the expectation of a faster corporate profit growth in India and the country's unique position among emerging markets. "Any negative impact would be restricted to the domestic bond market. I see minimal risk of a sell-off in equities given that corporate profit growth in India is likely to be among the best in the world for the next two years," said G Chokkalingam, chief executive, Equinomics Research & Advisory.

)

)