Small-caps outdo bigger peers

158 small-cap firms post aggregate net profit growth of 104% against 16% each recorded by mid, large-cap players

Deepak KorgaonkarPuneet Wadhwa Mumbai/New Delhi

Small-cap companies which outperformed the large-and mid-caps at the bourses in the recently concluded quarter, have outshone their larger peers on earnings as well. Nearly 158 small-cap firms that have so far announced their June quarter results have seen their net profit more than double.

The combined net profit of 158 small-cap companies increased to Rs 2,685 crore in the April-June quarter against Rs 1,322 crore in the corresponding period last year. Among the mid-caps and large-caps segment, the bottom line rose 16 per cent each to Rs 10,725 crore from Rs 9,256 crore and to Rs 56,763 crore from Rs 49,037 crore, respectively during the June quarter, Capitaline data show.

“These are still early days as regards corporate results for the June quarter. There has been a 20 basis point (bps) improvement in the Ebitda (earnings before interest, taxation, depreciation and amortisation) margin for the broad market. The results have not exceeded expectations,” says Anoop Bhaskar, head, equity, UTI Asset Management.

“For the BSE 500, we are still 300 bps below the 15–year average on Ebitda margin, which I expect will be made up over the next two to three years. Going ahead, an uptick in demand will help improve corporate earnings, which are likely see a double digit growth over the next four years. Urban India is likely to drive this growth in demand,” he adds.

Of the 158 small-cap firms, net profit of 17 companies has more than doubled. While 37 companies posted a growth in the range of 25-100 per cent, six firms reduced their losses during the quarter. The aggregate net profit of 342 companies, including banks and financials, increased 18 per cent from Rs 59,610 crore to Rs 70,173 crore during the first quarter this year.

Says Sunil Jain, vice-president, equity research, at Nirmal Bang: “One has to evaluate the performance on a case-to-case basis. A lot of these companies have been doing well since the past few quarters and this has been reflected in their stock prices as well. I expect this to continue. However, I don’t think that a turnaround in the economy has yet been reflected in the performance. Whenever this benefit trickles in, the large-caps will be first to benefit followed by the mid-caps and the small-caps.”

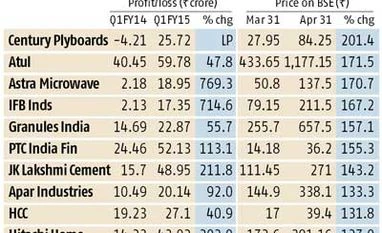

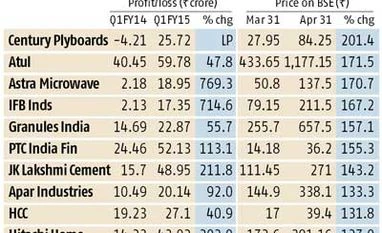

HEG (Rs 20.75 crore), Astra Microwave (Rs 18.95 crore), Mahindra Lifespace Developers (Rs 179 crore) and IFB Industries (Rs 17.35 crore) have recorded more than 700 per cent year-on-year jump in net profit.

A lot of small-cap companies would have also benefitted from the rupee–dollar equation. They are feeders to the mid-cap and the large-cap firms and produce goods that are good import substitutes, analysts suggest.

Two Tata Group Companies – Tata Sponge Iron and Tata Elxsi, Indoco Remedies, TTK Healthcare from pharmaceuticals and Eveready Industries, Hitachi Home and Life Solutions, JK Lakshmi Cement, Avanti Feeds and TV Today Networks are among a few that posted profit growth over 75 per cent over the previous year’s quarter.

Strong show

A strong financial performance by these companies has reflected in the stock price. Over a three-month period, stocks of these small-cap companies have gained the maximum in terms of price. The price momentum in these stocks signifies the interest that they have been generating in the markets.

Since April, the BSE Small-Cap Index has rallied 40 per cent compared to 29 per cent rise in Mid-Cap Index and 14 per cent gain in 30-share Sensex. Century Plyboard, Astra Microwave, IFB Industries, JK Lakshmi Cement and Hitachi Home and Life Solutions have appreciated more than 100 per cent since April.

Going ahead, one needs to be stock careful and adopt a stock specific approach while making a fresh investment call. Evaluate the companies on a fundamental basis and invest accordingly, suggests Jain.

“In the small-cap and the mid-cap pack, we like V Mart Retail, Wonderla Holidays and Suprajit Industries. In the cement pack, we like JK Lakshmi Cement and JK Cement, Ramco Cement, Shree Cement. Besides this, we also like Ashok Leyland and TVS Motor from a pure momentum perspective. From a re-rating perspective, Finolex Cables is a good bet. Repco Home Finance is a good growth story. In the seeds space, we have like Kaveri Seeds and Unichem Labs in the pharma space,” says Ravi Shenoy, AVP-Midcaps Research, Motilal Oswal Securities.

)

)