Indian markets are trading above historical valuations, said Tirthankar Patnaik, chief strategist and head of research, India, Mizuho Bank. Emerging markets begin to look risky during a trade war scenario. Rising interest rates mean debt begins to look more attractive than equity.

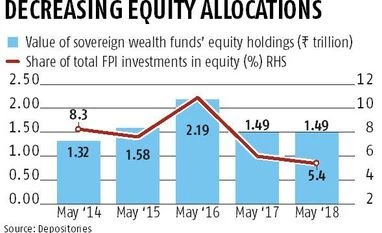

“For a sovereign wealth fund, equities in general were expensive,” he added.

Some improvement in earnings is expected for India. A June 2018 Motilal Oswal Securities India Strategy report noted that markets would see better earnings, but markets would remain under pressure. “We expect FY19 to herald the earnings recovery for India, although the market will remain distracted by global and local macro events such as the ongoing global trade war, US Fed rate increase cycle, potential moderation in domestic equity flows and political developments,” according to the report.

)