Stay long, keep a trailing stop-loss

Devangshu DattaThe market continued to rally to highs in the hopes of reforms. The next major trigger could be the Budget and the President's address outlined some possible focus areas where the new government could go.

The breadth of the market looks firmly positive, with advances comfortably outnumbering declines and high volumes. Small caps and mid caps are outperforming the large caps, foreign institutional investors (FIIs) and retail investors continue to display positive sentiment.

This move offers straightforward trading possibilities for trend followers: Stay long and keep a trailing stop-loss. It is impossible to set targets because the indices are in new territory. On the downside, the short-term trader could keep a stop-loss at 7,500, allowing for a correction of two per cent. Long-term players may want to set a deeper stop-loss.

The market is over-bought but is in the sort of strong trend where it can remain so indefinitely. The Nifty's June put-call ratio (PCR) is at 1.09 and the three-month PCR is at 1.05. This is about normal and has improved from being over-bought. The danger is the Nifty has gained so much ground so quickly, the next correction could be quite deep.

Pretty much every sector has done well since the general elections, with the exception of the information technology (IT) sector. Underperformance there is linked to a stronger rupee. The Bank Nifty should, by history, start outperforming the broader market soon. The index has good support at 15,000, and a breakout above 15,500 on Monday could mean a test and breach of the record of 15,742.

The rupee could continue to harden, given strong FII inflows and expectations of strong foreign direct investment (FDI) inflows. The Reserve Bank of India (RBI)'s inputs will be critical. It will be worth tracking the RBI's intervention levels with respect to dollar-rupee movements, and the RBI's cut-off yields at treasury auctions. The latest credit policy allowed FIIs to play the Indian currency derivatives market and that could mean some changes in perspective if the local market deepens.

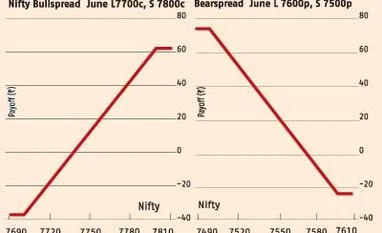

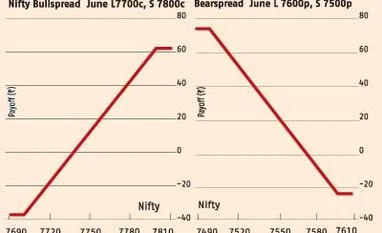

The distribution of open interest (OI) across the June Nifty option chains makes a move of anywhere between 7,000 and 8,000 possible. The put open interest (OI) is heavily clustered between 7,000 and 7,600 while the call OI is heavily clustered between 7,600 and 8,000. This plateau formation across a broad range is unusual but then the last three months have been extraordinary. Volatility could stay high till the Budget. The Nifty is being traded between 7,600 and 7,700 and there's support at every 50 points below 7,600. A long June 7,700p (82) and short 7,800c (44) costs 38 and pays a maximum 62. A long June 7,600c (68) and a short 7,500c (41) costs 27 and pays a maximum 73. Both risk:reward ratios are reasonable. These two close-to-money spreads could be combined but the return would not be attractive. The trader looking for non-directional cover could take a long 7,800c and long 7,500p combined with a short 7,400p (24) and short 7,900c (22). This long-short strangle combination has a maximum cost of 38 and maximum returns of 62, with break-evens at 74,627,838.

)

)