Stocks extend weekly gains as lenders advance

The Sensex has retreated in December only twice in the past decade

Bloomberg Indian stocks advanced, with the benchmark BSE rebounding from its biggest loss in a month, as lenders and metal producers climbed.

ICICI Bank, the country's biggest private lender, climbed to a two-week high. The stock was the best performer on the S&P BSE Bankex, which jumped 1.4 per cent. Tata Steel rallied to a four-month high, while Oil & Natural Gas Corporation (ONGC), the largest state-owned explorer, increased to its highest price in nearly three weeks.

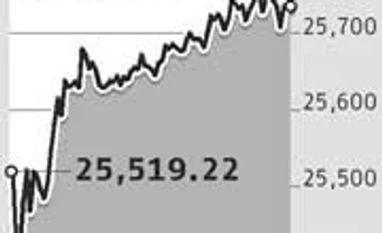

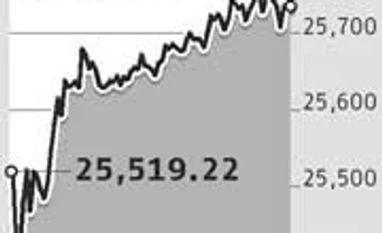

The Sensex gained 216 points (0.85 per cent) to close at 25,735.9, after posting its steepest drop since November 18 on Friday. The Sensex still halted two weeks of losses after the US Federal Reserve (Fed) raised interest rates for the first time in nearly a decade, ending a period of uncertainty. The Sensex has retreated in December only twice in the past decade, data compiled by Bloomberg show.

The NSE too gained 72.5 points (0.93 per cent) to end at 7,834. 5. "We have all the reason to remain bullish until December 31 as there will be some sort of net asset value-management in the large caps before the year ends," Ashish Maheshwari, a director at Blue Ocean Strategic Advisors, said. The Fed's decision has been "priced in," he said.

ICICI Bank rallied 3.2 per cent, reducing this year's loss to 27 per cent. Axis Bank rose 2.3 per cent, State Bank of India climbed 1.7 per cent. The Bankex rose to its highest level since December 8.

Tata Steel increased to its highest level since August 10, while ONGC rallied 3.2 per cent, trimming this year's loss to 33 per cent.

Sun Pharmaceutical Industries, India's biggest drugmaker, tumbled 4.6 per cent, the most since November 9, after it got a warning letter from the US Food and Drug Administration (USFDA) following an inspection at one of its facilities. HSBC Holdings cut the stock's rating to hold from buy, while Morgan Stanley reduced it to equal-weight from overweight.

Sun received the warning as a result of the inspection in September 2014 at its Halol facility in Gujarat, the drugmaker said on Saturday. The USFDA has withheld future product approvals from this facility. Sun expects to seek a re-inspection by the USFDA on completing its "remediation commitments," according to the filing.

International investors bought a net $113 million (Rs 749 crore) of Indian stocks on December 17, taking this year's inflows to $2.8 billion (Rs 18,576.6 crore). The Sensex has fallen 6.4 per cent this year and trades at 15.2 times projected 12-month profits, versus 11.1 times for the MSCI Emerging Markets index.

)

)