Suuti's Axis Bank stake sale process begins

Finance ministry reportedly calls nine investment banks, recommended by Suuti, on Friday for stake sale in Axis Bank alone, not in ITC and L&T

Nishanth Vasudevan Mumbai The government has set the ball rolling for sale of its stake in Axis Bank, held by the Specified Undertaking of UTI (Suuti).

The finance ministry is said to have called nine investment banks, recommended by Suuti (restructured unit of the erstwhile UTI) on the coming Friday, to make a pitch for managing the proposed share sale in the private lender.

Sources in the know said the invite was specifically for the sale in Axis Bank and not for ITC and Larsen and Toubro (L&T), holdings in which are also with Suuti. This has sparked speculation that the government might not sell the latter two stakes in the near term. Investment bankers said there had been fear about hostile takeovers in ITC and L&T if the government sold its holdings in the two companies separately. None of the three companies have a majority shareholder.

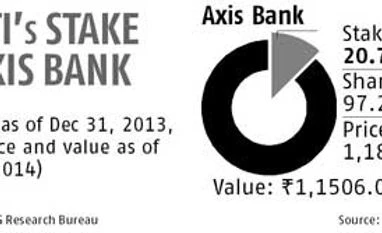

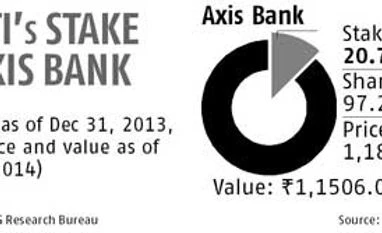

Suuti was created in 2002 after the then UTI was wound up, following the US-64 fiasco. It has 23.58 per cent stake in Axis Bank, 11.54 per cent in ITC and 8.27 per cent in L&T. The total value of Suuti’s stakes in the three companies was Rs 48,135 crore on Monday. The Union cabinet had, late last week, approved the sale of government holdings in these companies.

Sources said the nine investment banks suggested by Suuti to the ministry for the Axis sale include Citi, JPMorgan and Morgan Stanley. They say there are no domestic banks in the list. Bankers said the decision to ask foreign investment banks is to ensure high participation by foreign investors, as the Axis share sale is expected to be among the biggest in recent times. Last month, the government had approved Axis’ proposal to raise its foreign investment limit to 62 per cent from the present 49 per cent.

“The idea is to get maximum FII (foreign institutional investor) participation. The government does not want to take any chances, with the financial year coming to an end,” said a banker in the know.

The government is struggling to meet its 2013-14 disinvestment target of Rs 40,000 crore before March 31; it, has raised barely Rs 3,000 crore so far, including Rs 1,637 crore from stake sale in Power Grid Corporation recently.

)

)