Textile sector on cusp of revival

However, textile industry reviving and some of closed mills could restart if they can manage to upgrade themselves

Komal Amit Gera Chandigarh The textile sector in India, in crisis for the past few years, may now be on the cusp of revival. Experts are turning optimistic as some spinning mills could restart if they manage to upgrade themselves.

Last year was encouraging and the current one is also likely to fetch good business. Demand (export orders) is consistent and supply of crop good. Non-operative units, said millers, might restart operations with the revival of the Technology Upgradation Fund Scheme.

About 383 spinning mills are non-operational. Of these, 184 are in Tamil Nadu. The latter and Gujarat have 70 per cent of non-operating mills. Gujarat has the second-highest number of closed mills.

Tamil Nadu has the most mills (2,000 in the large, medium and small categories). It has a spindle capacity of 23 million.

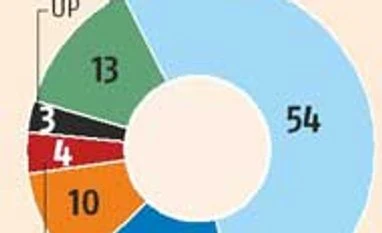

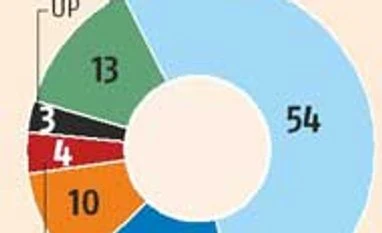

A study by the Associated Chambers of Commerce and Industry of India (Assocham) said Tamil Nadu accounted for 54 per cent of the non-operative mills, followed by Gujarat (16 per cent), Maharashtra (10 per cent), Punjab (four per cent) and Uttar Pradesh (three per cent). The study was based on a comparative analysis between FY00-01 and FY10-11 and an annual survey by the statistics and programme implementation ministry.

K Selvaraj, general secretary of the South India Textile Millers’ Association, said the sector had seen a tough phase during 2008-2012. The impact of the global slowdown had coincided with price volatility of cotton. The crisis in Tamil Nadu was worsened with an acute power shortage that rendered many private mills unviable. The changing global environment in terms of higher demand for Indian cotton yarn and a surge in domestic demand has put this sector on a higher growth trajectory. He added the power situation in Tamil Nadu had drastically improved.

In the past few years, he said, no state had registered any new investment in the sector.

He added to remain more competitive in the global market, the sector needed to modernise. According to the Assocham study, low productivity, lack of advanced technologies and foreign investments, supply-chain bottlenecks, lack of economies of scale, labour challenges, a fragmented industry and weak brand positioning are the key reasons for the non-operation of mills.

While the private millers said the bulk of the non-operational mills fell in the cooperative and government sector (National Textile Company), the loss to the private sector is not small.

The last year was quite encouraging and the current year is also likely to fetch good business for spinning sector. The demand (export orders) is consistent and supply side (cotton crop) is firm.

The non-operative units, said the millers may restart the operations as the funds are also available with the revival of TUF (Technology upgradation funds) and steady demand for yarn assures the return on investment.

)

)