Traders maintain bullish bets on July series expiry

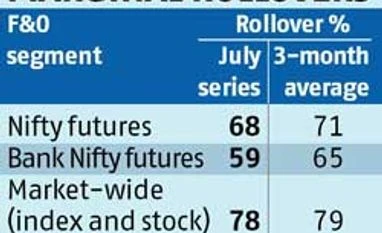

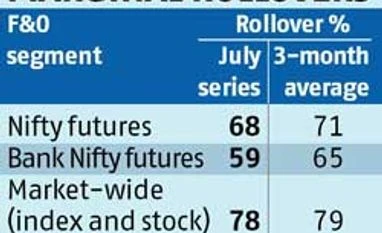

Sneha Padiyath Mumbai Traders rolled over the long positions from the July series into the next month August series, reinforcing their bullish stance in the market. The Thursday derivatives expiry session saw the Nifty futures and market-wide rollovers being slightly higher than the average-levels. But those of the Bank Nifty have been lower.

"This is a range-bound market with a slightly positive bias. The rollover in the index futures has been in line with the average which means that there is no major threat to the direction in which the market is headed," said Siddharth Bhamre, head of derivatives, Angel Broking.

Rollovers of the long positions in the Nifty futures on Thursday's F&O expiry trading session stood at 68 per cent, slightly lower than the three-month average of 72 per cent.

However, rollovers in the Bank Nifty remained lower at 58 per cent as against a three-month average of 65 per cent. Analysts said the lower rollovers were on account of the weak June quarter earnings numbers announced by some of the PSU banks. Besides, the Bank Nifty underperformed the benchmark Nifty during this series. The Bank Nifty was up 1.4 per cent while the NSE Nifty rose about three per cent between the June and July series expiry sessions.

"There are some negative developments in the PSU banking space with some short positions being created. This is mainly because of the mixed bag of results we have seen so far. But the outlook for the private banks seems positive," said Bhamre.

Rollovers in the market-wide positions were at 78 per cent as against the three-month average of 79 per cent.

"The very fact that rollovers stand on a relatively higher note on both the Nifty and market-wide front, we believe the participants have rolled over the bullish bets into the August series. However, this goes without saying that the scope for disappointment is very thin. Monetary policy review and the quarterly results will decide the further course of markets," said Yogesh Radke, head of quantitative research, Edelweiss Securities.

The total value of the market-wide open interest in the July series was Rs 69,000 crore as opposed to Rs 65,000 crore seen in the June series.

Analysts said among stock futures there was a positive bias towards stocks of defensives like technology, healthcare and FMCG sectors. A weakening rupee and good results had led to a rise in long positions in these stocks, especially from the foreign institutional investors (FIIs), market participants said. "FII long interest continued in stocks like HDFC Bank, Grasim and Lupin, where the FII-limit have already been hit in the cash segment," said Radke.

Stocks of the infrastructure sectors saw a huge rise in open interest in this series. According to an expert, L&T saw a 75 per cent rise in open interest but with a large number of short positions. On the other hand, Bharti Airtel saw long formations with a similar increase in open interest.

)

)