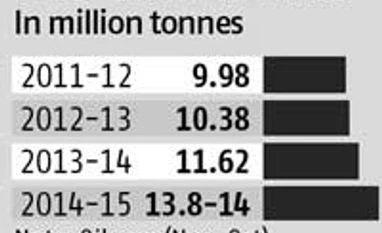

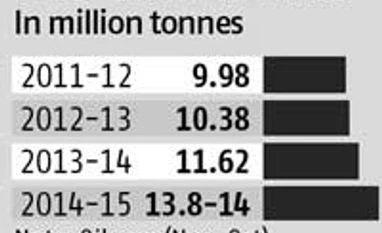

Veg oil import to set new record at 14 MnT this year

Falling vegetable oil prices have proved a bane for Indian seed crushing industry

Dilip Kumar Jha Mumbai India’s vegetable oil import is likely to set a new record at 14 million tonnes (mt) this year, on lower availability from domestic sources and subdued prices. This would be a rise of a little over 20 per cent from the 11.6 mt in 2013-14.

Last month, the import jumped 35 per cent to 1.5 mt, the highest monthly figure, from 1.11 mt in the same month last year, according to the apex industry body, the Solvent Extractors’ Association (SEA). In the nine months to July, import rose 26 per cent to 10.35 mt compared to 8.2 mt in the same period last year.

“Assuming the pace of import growth continues, veg oil import might touch 13.8-14 mt in the current oil year (November 2014–October 2015,” said B V Mehta, executive director, SEA. India meets nearly 60 per cent of its annual veg oil demand of 22 mt through imports from Indonesia, Malaysia and Argentina. The significant rise this year is due to two major factors.

Unseasonal rain in the peak rabi harvesting season damaged the crop extensively, resulting in less output of seed and availability for crushing. Also, falling global prices on excessive availability have brought global players here.

“India is being used as a dumping ground for excessive supply of edible oils in the world market,” complains Mehta. “Excessive import has put tremendous pressure on local prices, which are at a level where oilseed growing farmers are in distress and losing interest in the crop. The country’s dependence on imported oil has further increased to nearly 70 per cent, an alarming situation for food security.”

Expert Dorab Mistry expects crude palm oil price from Malaysisa to decline to 1,900 ringgit by September from around 2,000 ringgit now.

“Domestic seed crushing units' operating capacity has reduced to 35-40 per cent,” said a senior industry official.

If the government does not protect the industry through a rise in import duty, the units would start closing down,” said a senior industry official.

The average price of RBD (refined, bleached and diodised) palmolein slumped to $648 a tonne in July from $674 a tonne in June and $827 a tonne in July last year. That of crude palm oil price slumped to $618 a tonne in July from $653 a tonne in June and $834 in July 2014.

)

)